With Memo Bank’s business expense management, your entire company saves time. In a matter of seconds, create a physical or virtual card, assign it to a collaborator, and set a budget. No more sharing card numbers.

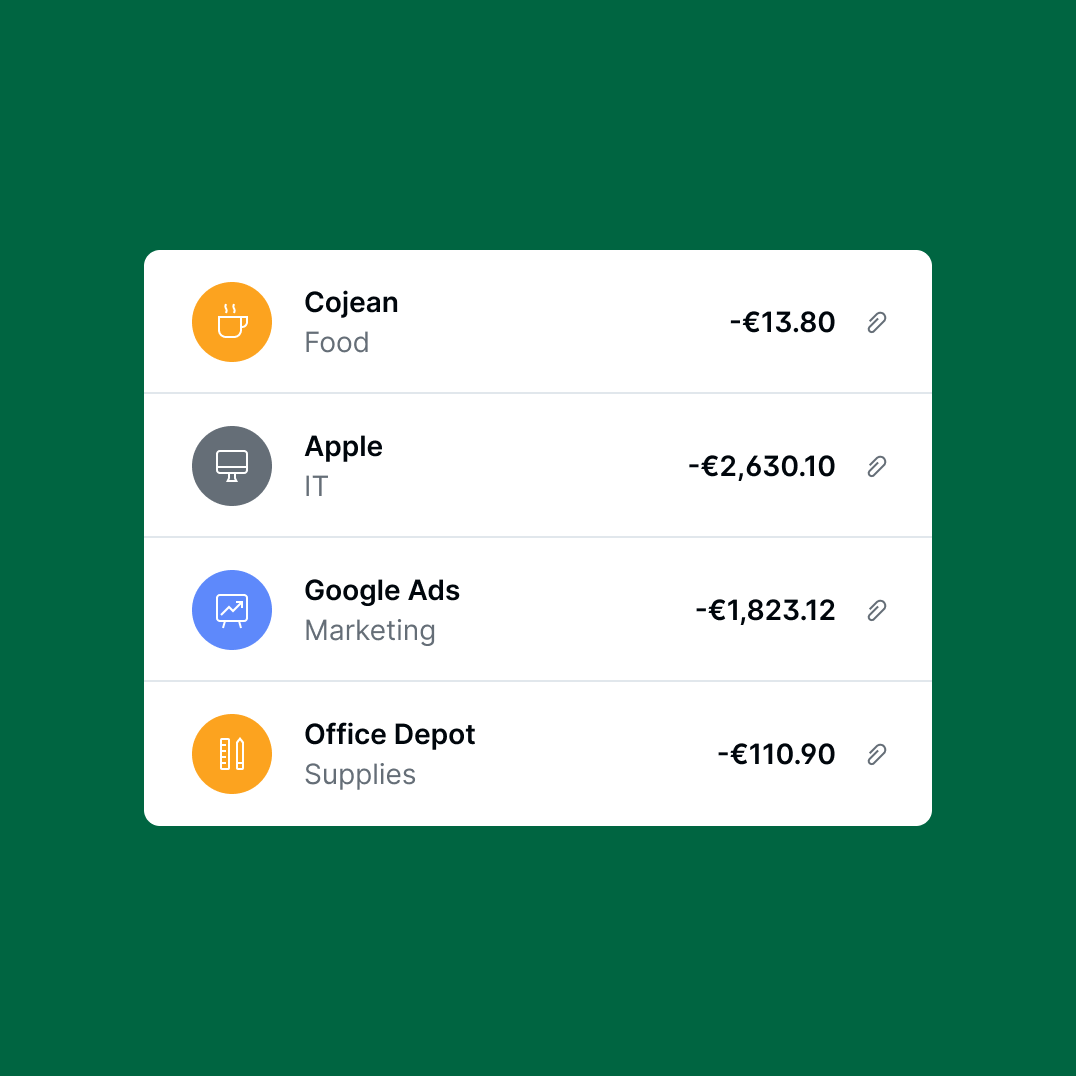

Delegate business expense management to your divisions and supercharge expense monitoring. Within your Memo Bank account, a simple click on a division’s bank card reveals a consolidated, real-time overview of all expenses incurred. Effortlessly search for expenses using the search bar and review transactions as far back as you need.

Your accountants no longer need to reconcile information scattered across different places: all data is centralized on the Memo Bank account. And to save time for your accountants, your collaborators who have forgotten to add their receipts receive automatic reminder emails.

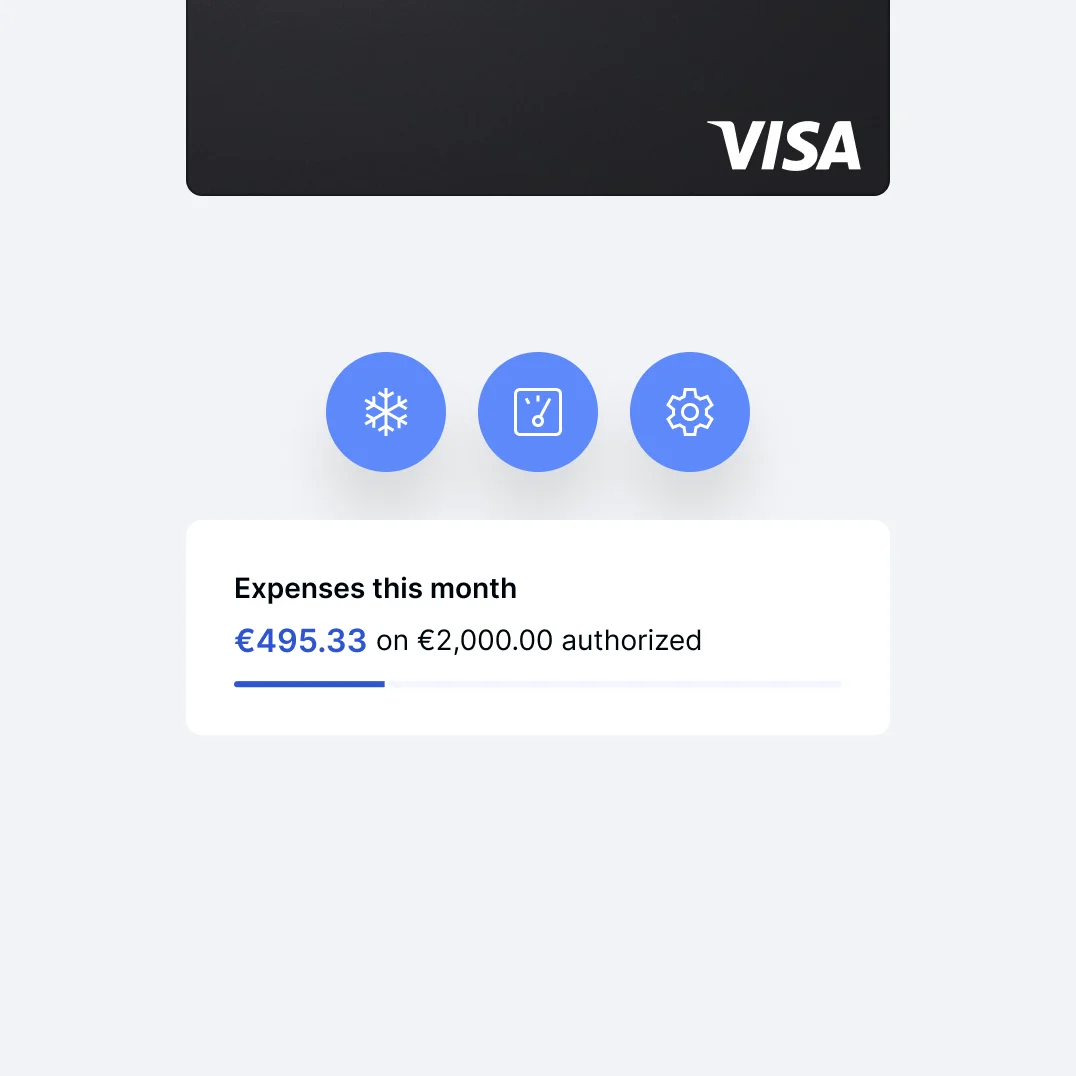

Memo Bank’s card limits are incredibly flexible. Whether you prefer limits or no limits, set weekly or monthly spending caps and adjust them at your convenience.

You can even specify merchant categories where your employees can use their cards – be it restaurants, petrol stations, hotels, or more. Tailor card usage by selecting the days they’re active, allowing you to block weekend spending, for instance. Configure these options for each card and modify them anytime.

Capture credit card receipts directly from your Memo Bank mobile app or your computer in your Memo Bank account. Our Optical Character Recognition (OCR) systems read your receipts and automatically add their information, such as the applied VAT rate.

Francis Pallini

Cofounder and CEO

Xavier du Parc, the CFO of Klox, explains how he reduced Klox’s working capital requirement (WCR) using Memo Bank’s deferred debit cards.

Digital marketing

40 employees (2023)

40 employees (2023) Paris (75)

Paris (75)Ecilia has reorganized its professional expense management system using virtual and physical cards from Memo Bank.

Software

20-49 employees

20-49 employees Lyon (69)

Lyon (69)Martin Leveau, CFO of Fleet, explains how their start-up maintains a negative Working Capital Requirement (WCR) thanks to its business model and Memo Bank’s deferred debit cards.

Computer equipment

20-49 employees

20-49 employees Paris (75)

Paris (75)Discover how Trusk, a provider of last-mile delivery services by electric vehicles (EVs), uses Memo Bank platform to streamline its expense management and other financial processes.

+100 employees

+100 employees Saint-Ouen (93400)

Saint-Ouen (93400)

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed