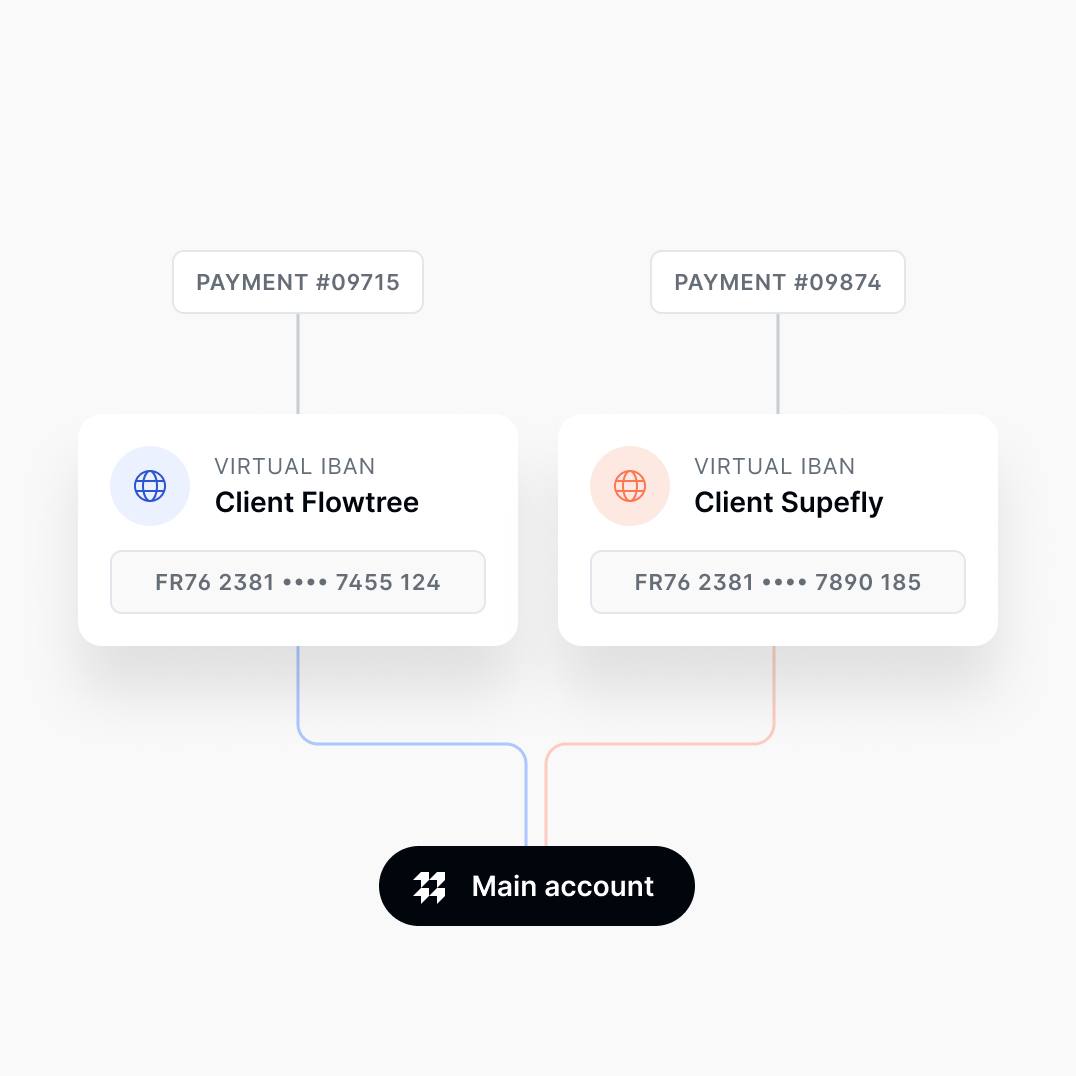

No longer spend hours sorting through incoming payments. Bid farewell to laborious hours spent sorting incoming payments. With each client allocated a unique virtual IBAN, the source of every SEPA or Swift transfer entering your account is automatically discerned and matched with transactions in your management, billing, or accounting systems. Clarity on payers and timelines is assured.

Memo Bank stands out as the sole banking institution in the French market empowering you to generate virtual IBANs via banking API. This flexibility allows dynamic assignment of virtual IBANs to clients and suppliers in accordance with your business protocols. Furthermore, you can develop applications seamlessly recognizing incoming and outgoing transactions through these distinctive identifiers.

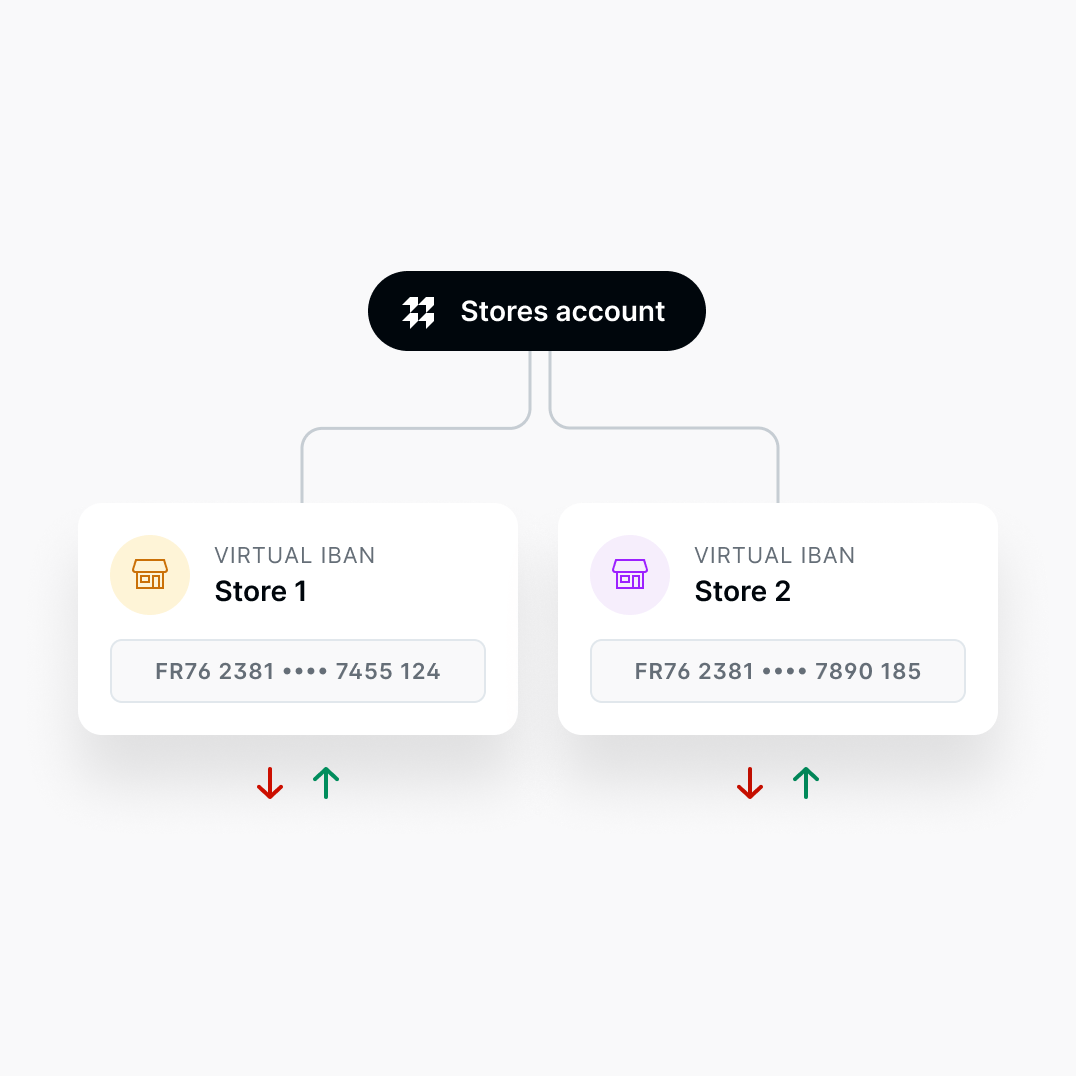

Virtual IBANs enable you to effortlessly manage and reconcile transactions associated with diverse subsidiaries, stores, departments, or product lines on a singular bank account. Each entity is endowed with its own virtual bank account, facilitated by the allocation of virtual IBANs. This facilitates automated identification of associated payments across your systems.

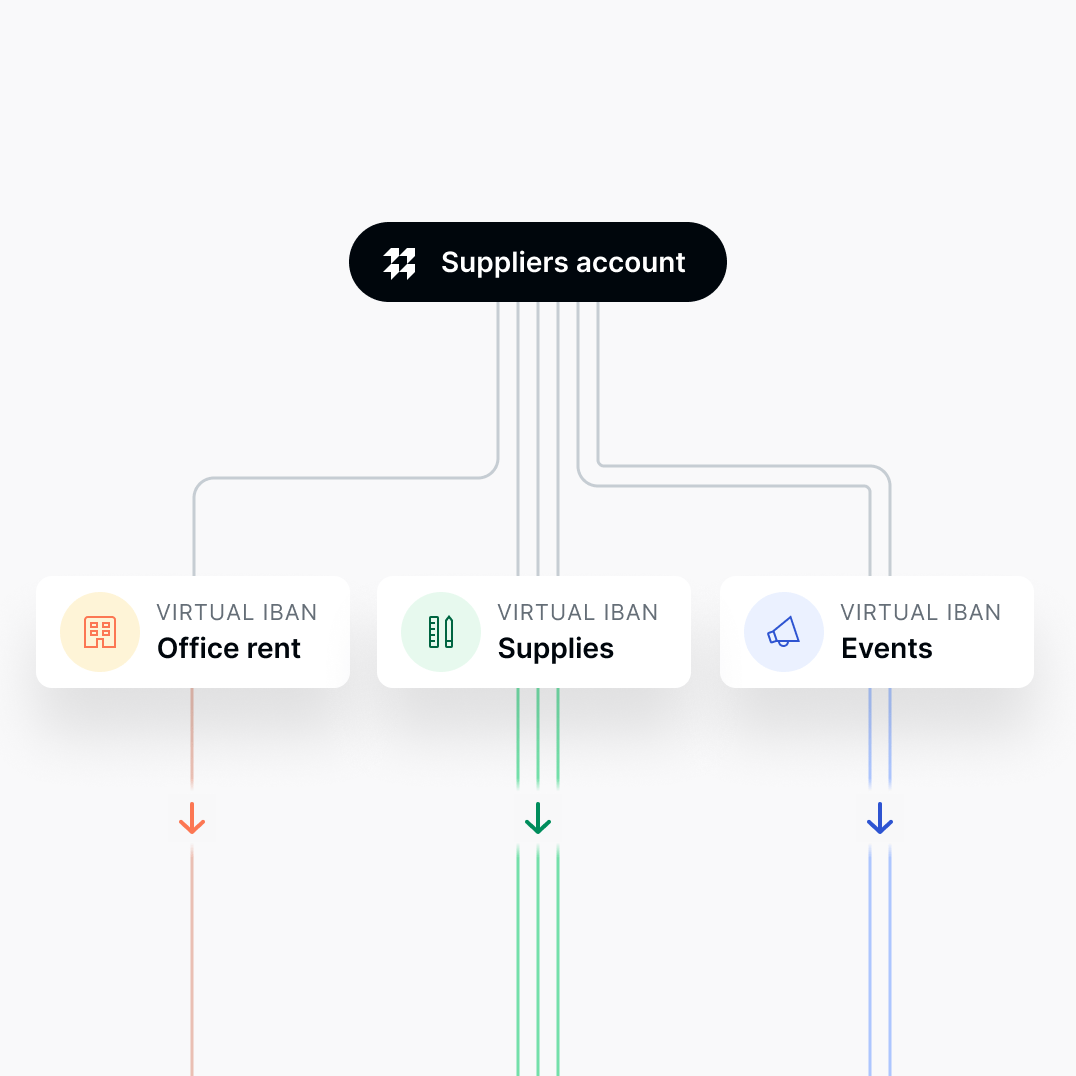

Similar to inbound transactions, virtual IBANs facilitate systematic categorization and tracking of outgoing payments. Simply assign a virtual IBAN to a supplier, initiate transfers from this designated virtual IBAN, or furnish your supplier with a direct debit mandate linked to this identifier. Moreover, you retain control by imposing limits on withdrawal amounts for each mandate.

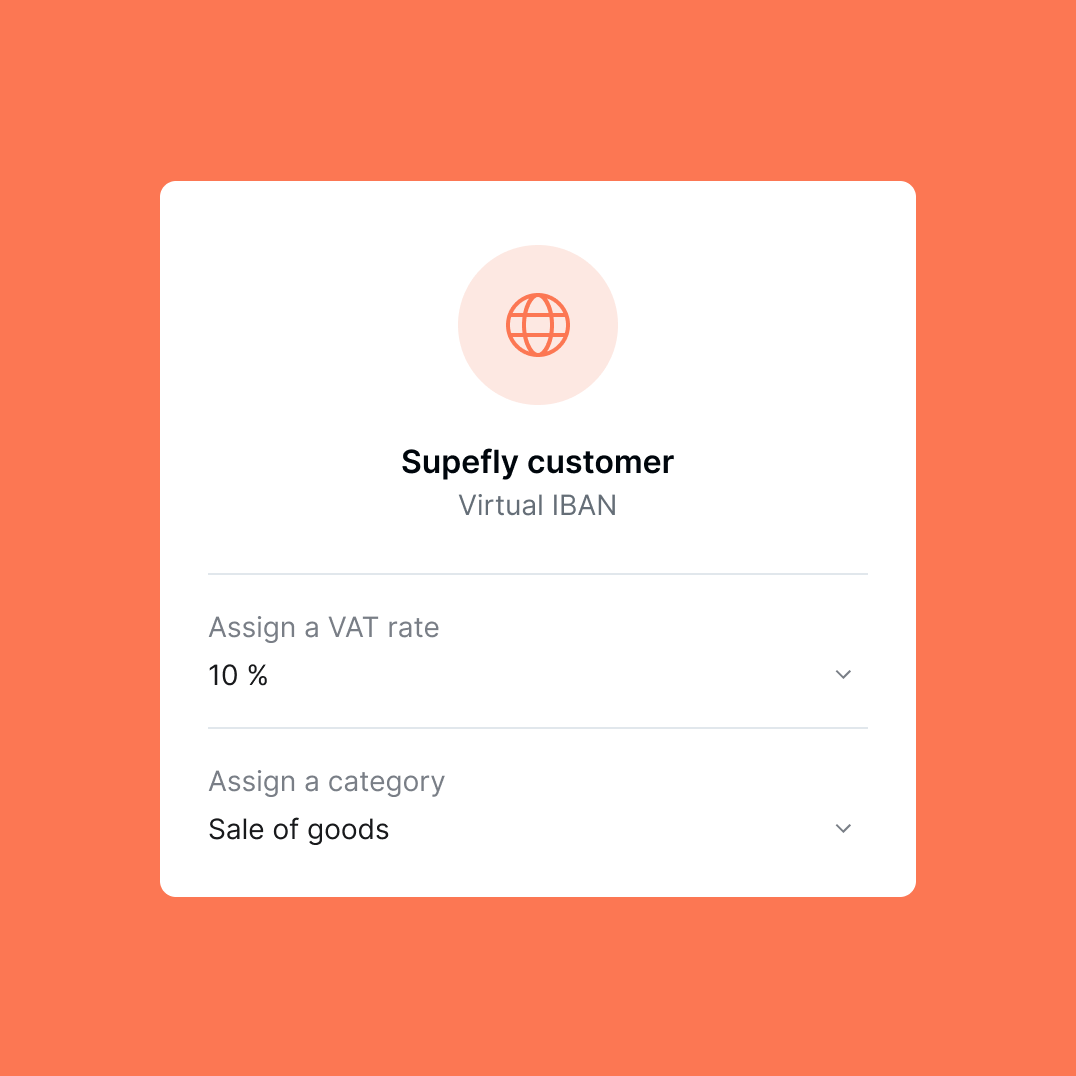

Empower your teams to align expense categories with virtual IBANs, ranging from groceries to marketing expenditures. This rationalization minimizes the arduous task of categorizing transactions and streamlines the association of each transaction with relevant expense and revenue accounts. Additionally, you can tailor each virtual IBAN to specific VAT rates, enhancing fiscal management.

Virtual IBANs enable seamless linkage of bank transactions with records in your billing, management, or accounting systems. This fortified connection streamlines detection of discrepancies, ensuring swift identification of transactions deviating in amount from recorded figures or those absent from your systems.

“Virtual IBANs enable us to monitor our payments in the most immediate manner possible.”

Charlotte Gounot

Head of Finance

How to reconcile cash flows and monitor the performance of 28 stores when sales from these outlets are deposited into a single bank account? Discover how the financial teams at Lunettes Pour Tous moved from a time-consuming reconciliation process to one that is largely automated.

Optical retailer

400 (2022)

400 (2022) Paris (75)

Paris (75)

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed