Memo Bank for Accounting teams

Elevate your accounting precision

Tired of the endless quest to track the origin and amounts of your incoming and outgoing payments? Seeking better control over the risks associated within your banking operations? Longing for quick access to reliable data? Memo Bank is designed for accounting teams. We value your expertise by providing you with access to a cutting-edge solution that speeds up the identification and reconciliation of accounting data.

Simplify your banking reconciliation process

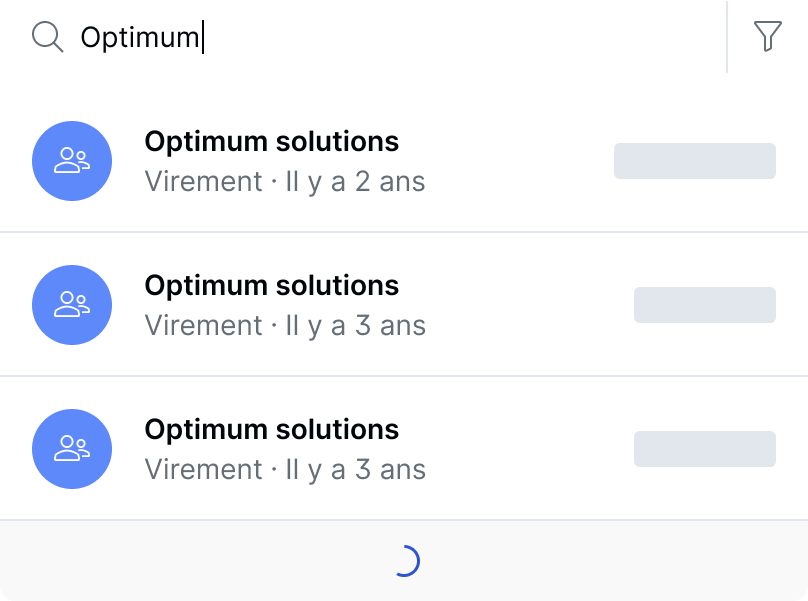

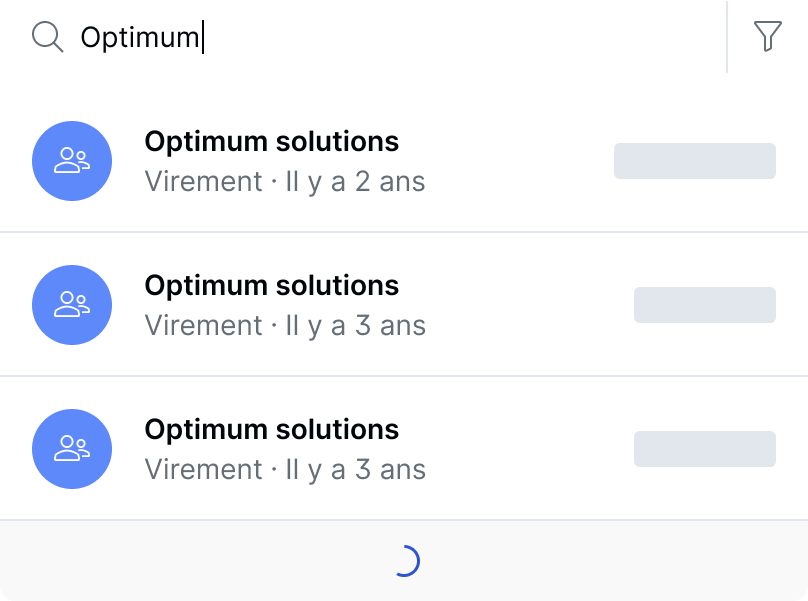

Access to all your banking transactions

Retrieve any transaction from your account history. No matter when your transaction took place, you’ll always be able to access its details. No need to scan many (digital or paper) statements or spreadsheets to find the details of a transaction that happened a while ago.

Stop chasing receipts

Are your employees struggling to upload their expenses receipts following a payment by card? Or perhaps they’ve forgotten to upload them? At Memo Bank, you have access to an expense management module. Both your life and that of your colleagues are made easier: uploading receipts only takes seconds, and you can send reminders to those who have not yet submitted their expenses. You can identify expenses with no receipts against it or access each receipt that has been submitted.

Assign VAT rates for each transaction

Stay ahead of your accounting requirements by assigning VAT rates for each transaction and directly from your Memo Bank platform. You then know the applicable rate with applies for each transaction before logging into your accounting software.

Effortless banking reconciliation

Virtual IBANs allow you to assign different IBANs to your current accounts. By communicating different IBAN to your clients, you can determine and identify the source of payments, even if there are no labels against these. Say goodbye to manual or overwhelmingly complicated banking reconciliation.

Manage your balances across your accounts

You can segment and break down your banking operations by teams, customers, suppliers, expenses, etc. Through our pricing plans, you can open up to 20 current accounts. However, you can open as many accounts as you want (on a standalone basis, once you’ve reached the maximum volume allowed with your pricing plan). Each account has its own IBAN.

Manage your outgoing payments

Always pay your employees on time

Through bulk-transfers, you can send up to 5,000 transfers in one go. Import your transfer orders in XLS, CSV, or XML and let Memo Bank execute those for the dates that you’ve chosen.

Pay your suppliers on time

No longer dip into your cash reserves days in advance to fulfil your payment obligations. No need to pay extra charges or having to experience low payment limits when issuing instant credit transfers. The default position at Memo Bank: standard credit transfers that are executed faster than traditional banks, and issuing Up to €100,000 and fee-free instant credit transfers.

Be in control of your employees' expenses

Through Memo Bank platform, you can generate, manage and configure virtual and physical corporate cards, all compatible with Apple Pay and Google Pay. Corporate cards are personalised and can be assigned to each employee or team. Categorise, track and control card expenses, in real time.

Mitigate the risk of fraud

Through virtual IBANs, you’ll never have to disclose the details of your physical current accounts. You significantly reduce your exposure to risk.

Our functionalities can let you block any outgoing movements from your current accounts, eliminating the risk of fraudulent activities on those.

Be in full control of your credit transfers

Worried about making mistakes when issuing a transfer? Having trouble setting up your transfers? With Memo Bank, you can cancel transfers, make bulk-transfers, quickly add beneficiaries, send proofs of payments, and much more.

Three powerful ways to exchange data with Memo Bank

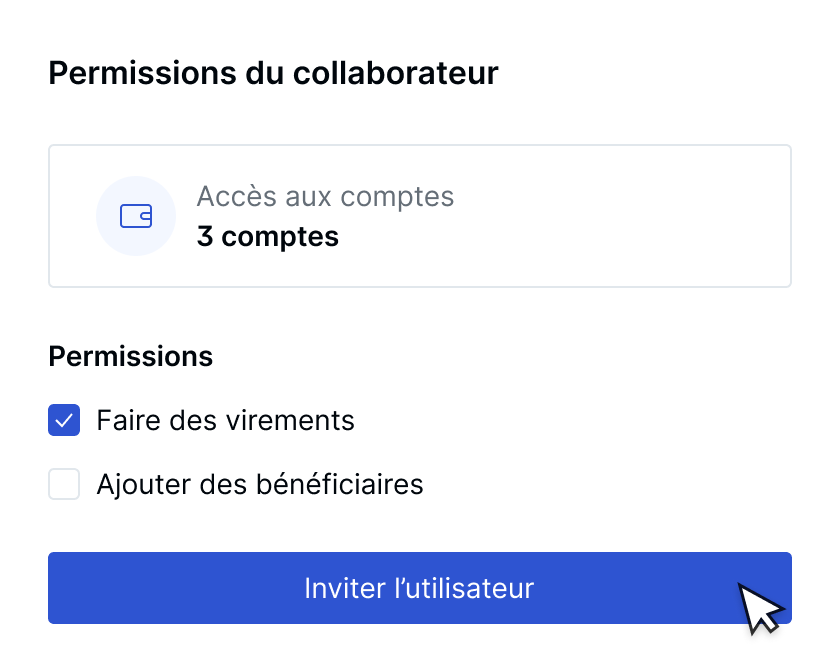

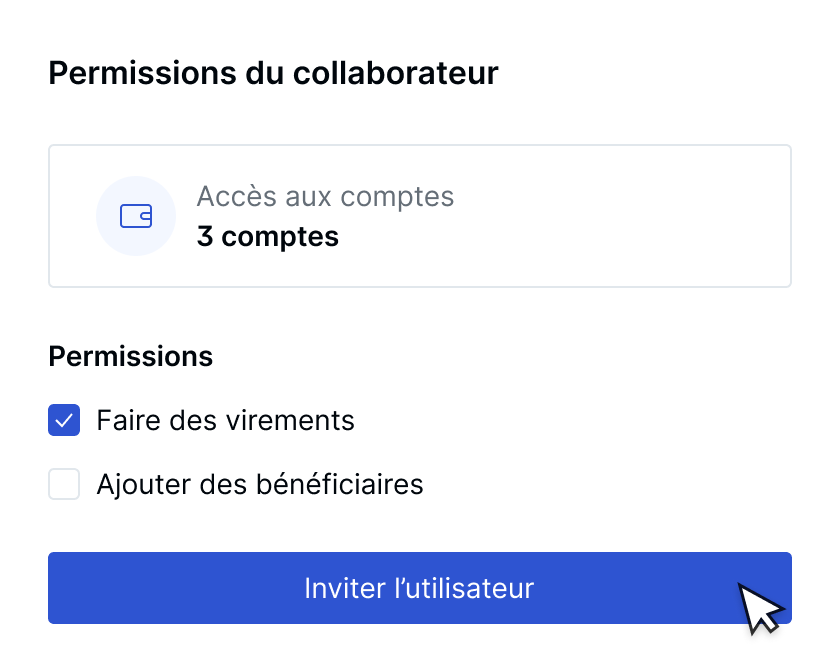

Customised access for your employees

At Memo Bank, you have full control over the tasks your employees can perform on your company’s bank accounts. Create access instantly, modify, or revoke permissions at any time.

End-to-end automation through API

Our Premium banking API goes well beyond regulatory requirements and surpasses Open Banking APIs. Collect payments through SEPA direct debits, issue single or bulk SEPA transfers, create virtual IBANs, manage your balance position across your accounts, etc. The realm of possibilities offered by our Premium API is vast. Our banking API allows you to execute and to identify transactions, at a granular level and in a rapid manner.

Banking communication protocol (EBICS)

Connect your current accounts held with Memo Bank to accounting and treasury software such as Sage, Cegid, Quadratus, Exabanque, Kyriba, etc. Connecting your accounts to jedeclare.com makes your life easier. Through the EBICS TS banking communication protocol, your data safely transits between your bank accounts and your accounting and treasury software.

A company thrives through its teams

Our solution is designed to meet the requirements of finance and accounting teams and C-level executives. Its benefits extend to all teams within the company.

Finance teams

Memo Bank is a true partner, a bank that knows how to support us when we need it.

Jean-Sébastien Moroni

Chief Financial Officer

of Moroni S.A