Virtual IBANs (vIBANs) are IBANs that conceal the details of your physical accounts' IBANs from your recipients. They can be used for both incoming and outgoing transfers and direct debits. Each virtual IBAN comes with its own bank account detaills (in PDF format) that you can share with your clients or suppliers.

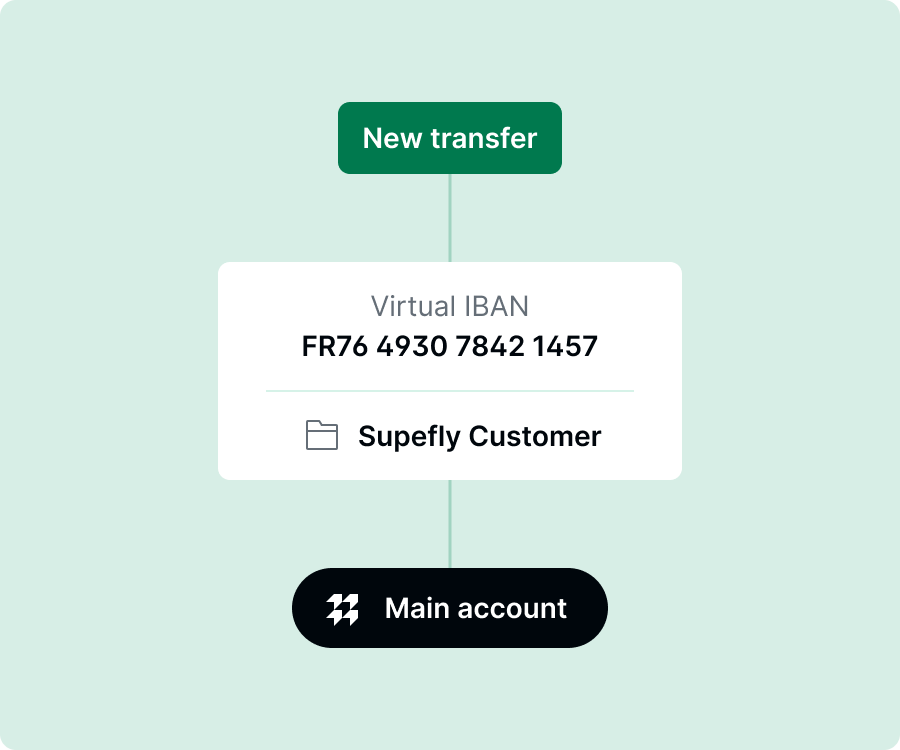

Assign a virtual IBAN to a client, a specific transaction, a business unit, or a store. Your finance and accounting teams will then be able to accurately and swiftly identify and reconcile incoming and outgoing transactions.

Through virtual IBANs, IBANs of your physical accounts are kept confidential and never revealed. The risk of fraud is then minimised.

Virtual IBANs allow your finance and accounting teams to segment funds associated with different projects, clients, suppliers, or activities, while using a single bank account.

Virtual IBANs enable accurate and granular traceability of your flow of funds or financial transactions, which will expedite and streamline the creation of both internal and external reporting.

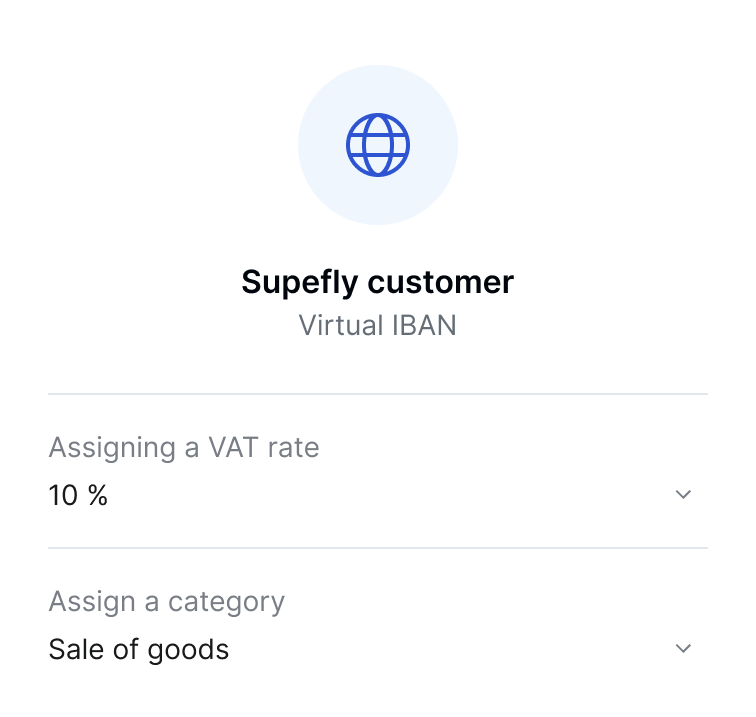

Assign a VAT rate to a virtual IBAN, and this rate will be automatically applied to all transactions flowing through this IBAN.

Our pricing is fixed, billed monthly, and based on your volume of transactions and not their amounts. Based on your pricing plan, you can generate between 100 and 2,000 virtual IBANs. However, you can create as many virtual IBANs as you need.

Virtual IBANs can be generated and managed directly and in full autonomy from either your Memo Bank account or via our banking API.

Choose the virtual IBAN which will appear against your outgoing transfers or which will be linked to your direct debit instruction. Change the phyiscal bank account to which an existing virtual IBAN is linked. At any time, you can disable or fully delete a virtual IBAN. Incoming and outgoing transactions made or received through this IBAN will then be rejected.

Optical retailer

400 (2022)

400 (2022) Paris (75)

Paris (75)

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris).

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed