The deferred debit option (Buy Now Pay Later) enables to posptone the payment of a purchase for 30 days after that order. Switch between the deferred or instant debit option on each card at anytime.

The only spending limit on your card is the one you set, not the one that is set for you. If your balance or your overdraft agreement allows it, there's no obstacle to making unlimited payments with your cards.

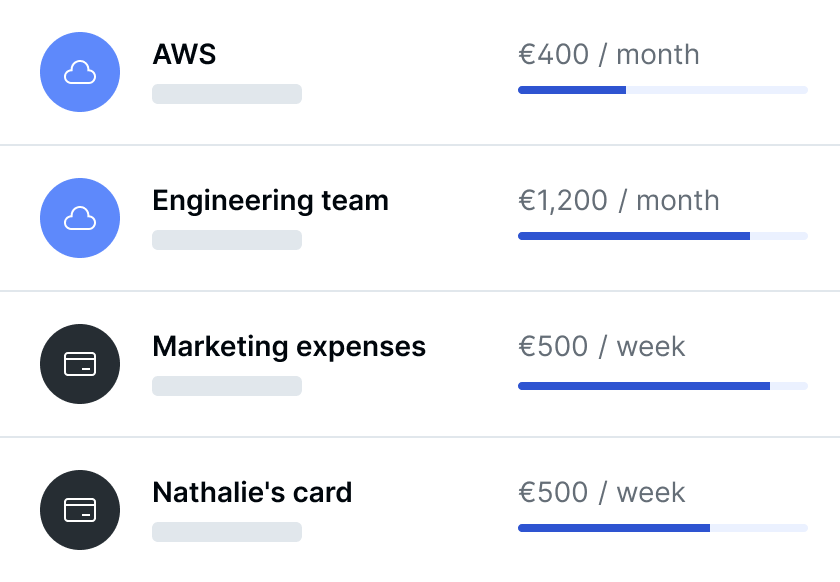

No need to juggle between various platforms to manage card expenses. Memo Bank allows you to centralise the entire card management process. Through a centralised and integrate module, you generate, configure, and track your team member's card spending, either at a granular level or at a card-level, awalys in real time.

Segment and track expenses by business unit (e.g., marketing, HR), type (e.g., advertising, furniture, traveling, etc.), or geography. You can now manage your budgets with more accuracy at any level (business unit, team, colleague), removing the risk of double-counting expenses or going over budget.

Empower your employees by assigning them to a card. Assign personalised cards linked to the business account for debiting. Your colleagues will not longer to use their personal accounts to advance the funds. They can easily upload their expenses via the Memo Bank mobile app.

Define payment limits and usage rules for each card. For each employee, you can define the type of merchants and/or the weekdays for which card payments are allowed. You can also block card withdrawals at ATMs.

Your finance and accounting teams will no longer have to wait for days to see card transactions or manually input card expense information into different systems. Your financial teams have access to all the information they need, in both a centralised and real-time way. And to save even more time, automatic email reminders are sent to colleagues who've forgotten to submit their invoices after making a card payment.

Generate physical or virtual (personalised) cards for your teams or each team member. Our cards are compatible with Apple Pay and Google Pay.

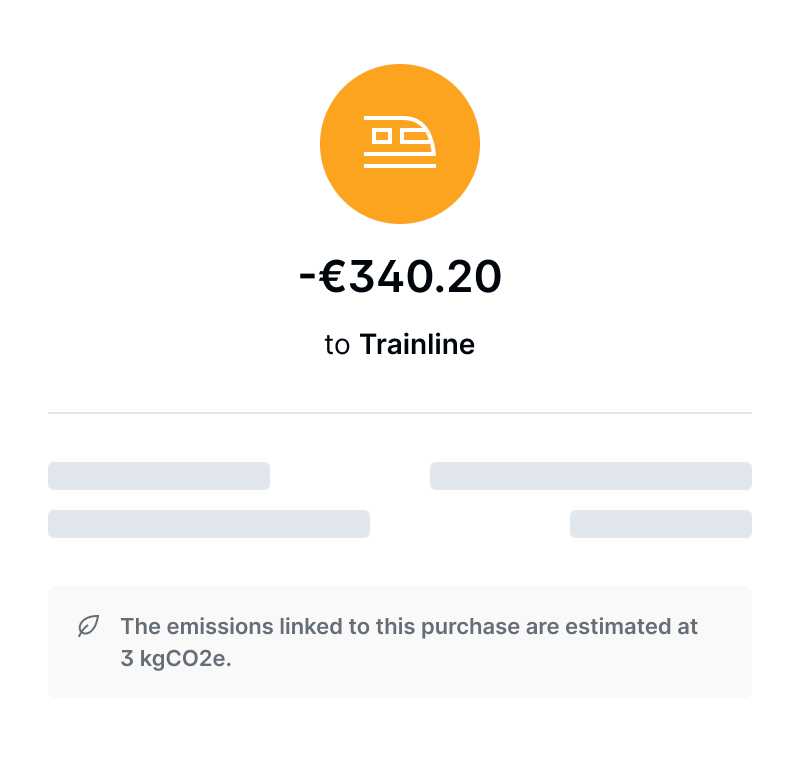

Each time you make a payment via a Memo Bank card, we'll calculate the carbon footprint associated with that payment. You can access this data to assess your carbon footprint.

Stay in control of the situation. Don't let unexpected card limits disrupt your (high-performing) online ads campaigns or cancel subscriptions to your favorite SaaS tools.

Remove the constraints you experience in managing expense reports. You can assign a corporate card to each of your team member. Our cards are available in both physical and virtual formats, can be personalised and are compatible with Apple Pay and Google Pay.

The deferred debit option will give you an extra 30 days to meet your financial obligations, lifting the pressure on your WCR.

+100 employees

+100 employees Saint-Ouen (93400)

Saint-Ouen (93400)

Computer equipment

20-49 employees

20-49 employees Paris (75)

Paris (75)

Digital marketing

40 employees (2023)

40 employees (2023) Paris (75)

Paris (75)Discover how our clients accelerated their development with Memo Bank

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed