Xavier du Parc found that there is only one institution in France that offers both deferred debit cards and modern, flexible management of expenses by bank card: Memo Bank.

Deferred debit

The Visa Corporate deferred debit cards from Memo Bank allow Klox to make purchases that are only debited on the first day of the following month. Klox thereby gains up to 30 days leeway on the payments for its advertising space purchases.

Integrated expense management module

Memo Bank equips its bank cards with an expense management platform that has enabled Xavier du Parc to rethink Klox’s spending policy and give more autonomy to his team members.

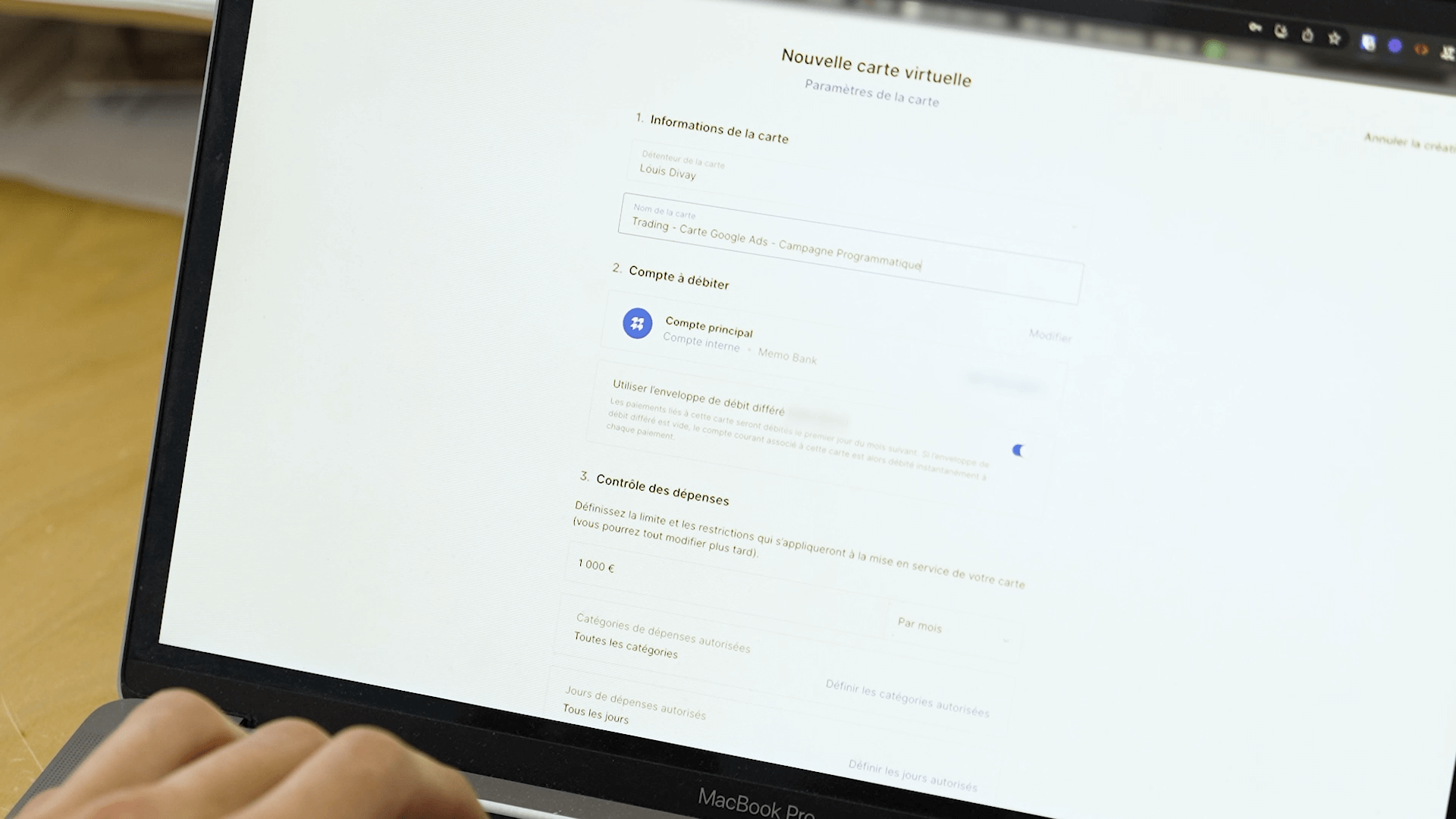

From his Memo Bank workspace, the CFO of Klox can create a virtual card and assign it to employees in just a few clicks. The traders no longer need to share a physical bank card designated for purchasing advertising spaces. Now, each has their own virtual card and access to the Memo Bank space, where they can copy the card number and view their transactions Meanwhile, Xavier du Parc can monitor all expenses in real time. A search engine allows for easy retrieval of transactions (with unlimited history), which can be filtered based on specific criteria.