Our teams have excelled in handling capital increases involving numerous subscribers (individuals or legal entities) and amounts exceeding several millions of euros.

As soon as you share with us the required documents, we will first open an escrow account to receive the funds of your capital increase. You have online access to this account, and you can start to engage with your investors.

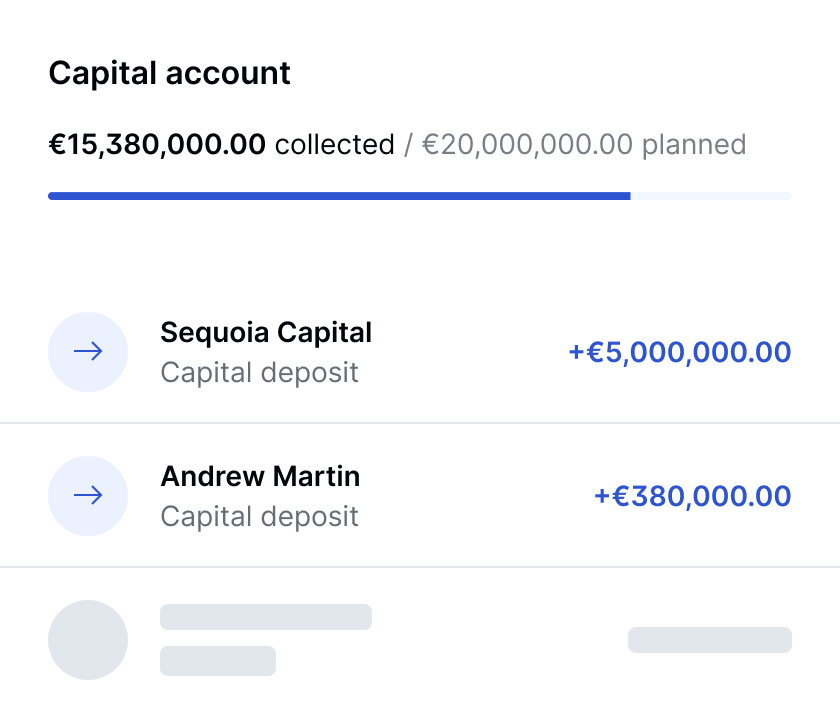

Track the transfer of funds in real-time on the escrow account. You have full visibility of the capital increase process, and it is simple to send reminders or chasers to your investors.

Whether your investors are located in France or overseas, they can transfer funds (in euros) through standard or instant SEPA transfers, or via SWIFT transfers.

Within 48 hours of receiving all the funds, we will issue a funds deposit digital certificate. Once the capital increase is confirmed from all parties, and administrative formalities are completed, we will transfer the funds to your current account.

The end-to-end automation of a capital increase might not (yet) be possible. In this context, no doubt that the quality of the individuals helping you will have a massive impact. Even a tiny error can delay the entire operation. Our teams are experienced in handling complex (as well as simple) capital increases involving numerous investors based all across the world.

You probably want to quickly complete (and put behind you) your capital increase, so that you can focus on other strategic priorities. Memo Bank is your ideal banking partner for managing your capital increase and your entire banking needs. As a regulated and independent bank, we provide exceptional products and services for your transaction banking needs, as well as giving quick access to loans.

Once the funds are credited in your Memo Bank account, you've different ways to earn interest on your surplus cash. For instance, by either opening our interest-bearing current account, or instant-access savings account or term deposit account, the last of which allows partial or full withdrawals.

60 employees

60 employees Paris (75009)

Paris (75009)

20 employees

20 employees Paris

Paris

+100 employees

+100 employees Saint-Ouen (93400)

Saint-Ouen (93400)Discover how our clients accelerated their development with Memo Bank

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed