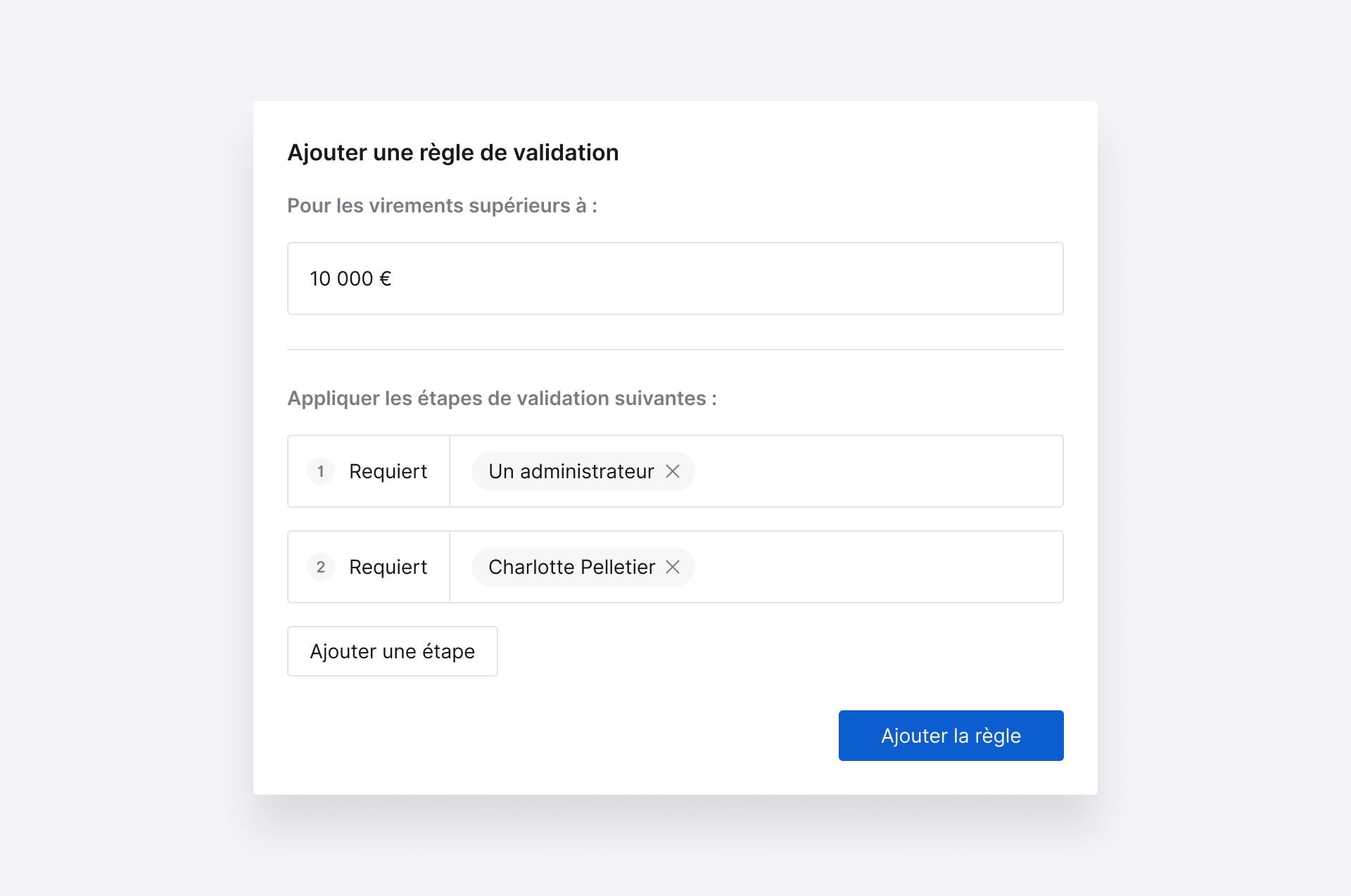

Each validation workflow requires three parameters for it to work:

- A kicker threshold, to set a limit above which each outgoing transfer needs to be validated by an admin, for example “this workflow gets triggered for every transfer above €10,000”;

- One or more owners, to define which admin needs to take part in a given workflow;

- Validation steps, to create cascading validations if needed, with one or several admins assigned to each step. For example, “the first validation should come from one admin (any admin) and the second validation should come from the VP of Finance (and nobody else)”.

Think of validation workflows as a way to draw a line between outgoing transfers that require validation (from an admin) and transfers that can be 100% managed by your team. For the time being, all users are subject to validation workflows and only admins can confirm validation steps.

Switching from transfer requests to validation workflows

How do validation workflows fit with transfer requests? Think of it as a classic case of before/after.

Before, with transfer requests, the fate of any outgoing transfer would hinge upon the role of each user:

- Most collaborators had to perform transfer requests for 100% of their outgoing transfers.

- Some collaborators were in charge of all their own outgoing transfers, from end to end. They enjoyed total autonomy.

Now, with validation workflows, the fate of any outgoing transfer hinges upon its amount:

- Some outgoing transfers can be taken care of by the collaborators who are allowed to perform bank transfers—you can still prevent any collaborator from initiating new outgoing transfers.

- Some outgoing transfers now need to be validated by one or several admins, regardless of the permissions granted to the users who initiated each transfer.

To help our clients switch from transfer requests to validation workflows, we created a first validation workflow on the Memo Bank workspace of companies that were using transfer requests. This validation workflow is triggered when an outgoing transfer’s amount exceeds €0 and any admin can validate it—there’s only one validation step in that workflow. You can either delete or edit this rule as you please. To find your validation workflows, just navigate to the “validation rule” tab of your Memo Bank account.

Works even when your teammates aren’t

To prevent your validation workflows from grinding to a halt when the admins in charge take some time off, you can attach several admins to any given validation step. Within any validation workflow, you can then create something like:

- I want Amandine OR Stéphane to validate the first step of the workflow;

- Then I want a second validation by either Éric OR Sophie;

- Finally, I want any admin to be able to validate the third (and last) step of the workflow.

That way, if Stéphane is out of office, Amandine can still take care of the first step of the workflow. And should Sophie take some time off, Éric could step in.

Tailor your validation rules to your need

If you want to fine-tune your validation workflows depending on the amount of each and every bank transfer, you may create several validation rules. For example:

- Between €0 and €10,000: no validation rule here, your team can handle outgoing transfers from start to finish, without admin supervision.

- Between €10,000 and €50,000: apply validation rule A, with its proper threshold, steps, and owners.

- For bank transfers above €50,000: apply validation rule B, with its own threshold, steps, and owners.