It’s an important day for the entire Memo Bank team, who have worked tirelessly to bring you what follows.

Payment cards have been our most requested feature, by far. We knew we had to ship them at some point. But we couldn’t just ship them and call it a day… Of course not.

So we went above and beyond that…

Today, we’re pleased to introduce three new products:

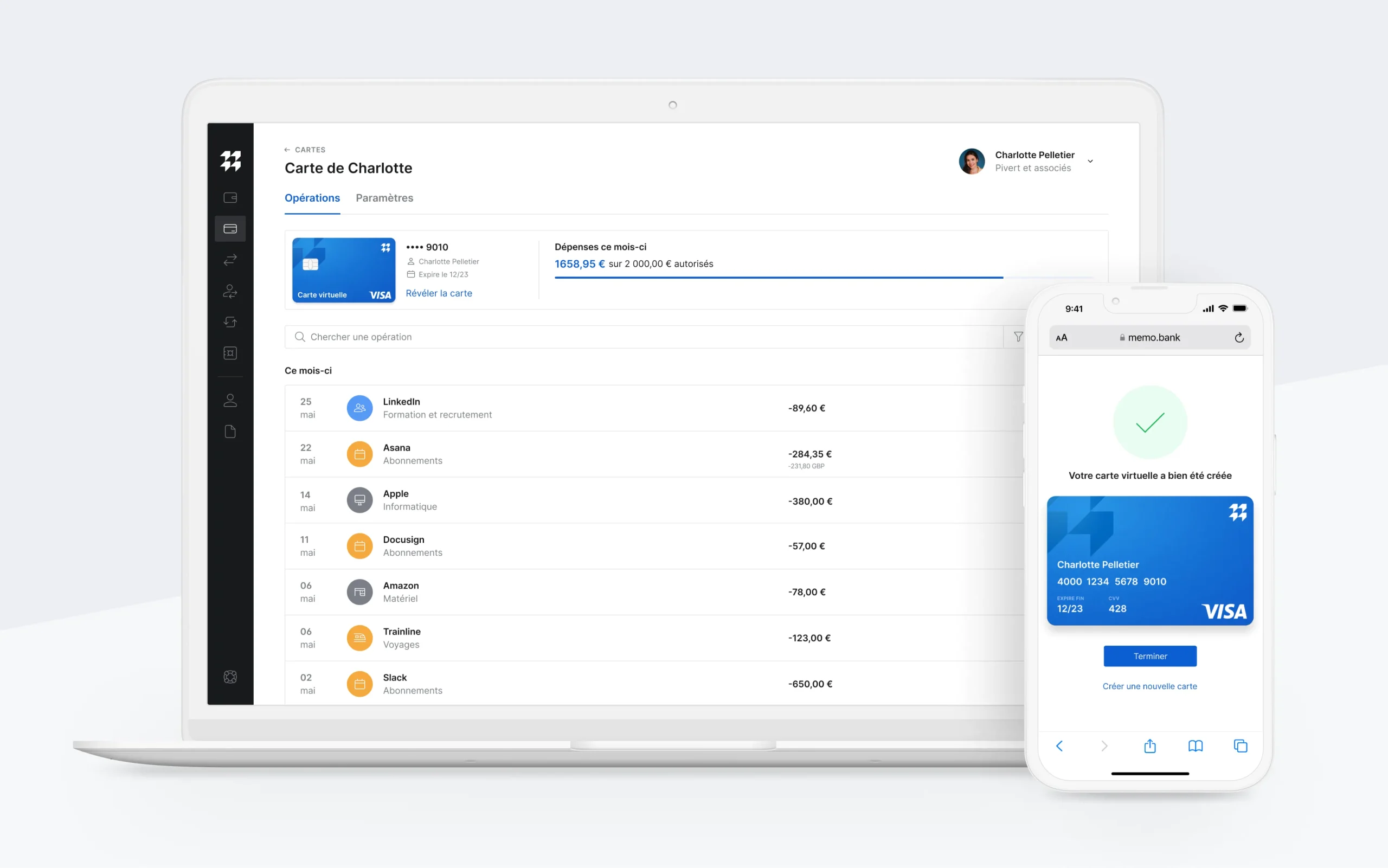

- The first one is a Visa corporate payment card (obviously).

- The second is a new expense tracking service with real time updates.

- The third is a Buy now, Pay later deferred debit feature.

So, three new products, right? Yes, three new products:

- A Visa Corporate payment card.

- An expense tracking system for the whole company.

- A Buy now, Pay later feature.

Think about it:

- A payment card.

- An expense tracking service.

- Buy Now, Pay Later

Again:

- A payment card.

- An expense tracking service.

- […]

Are you getting it?

No, we’re not talking about three separate products here. That’s right. We’re talking about a single_ product, fully integrated into Memo Bank’s ecosystem. But let’s stop here our Steve-jobs-launching-the-iPhone impersonation. Today, we’re introducing a little revolution to the world of corporate expense management.