If you’ve seen the movie Margin Call, you know that there are three ways to succeed in banking:

The first way consists of arriving first on a market, to crisscross it before the competition has time to enter (be first).

The second way consists of being smarter than the competition, which allows you to compensate for a possible ignition delay (be smarter).

The third way consists of… cheating, which probably allows you to create an illusion when facing faster or smarter competitors (or else cheat).

What is the relationship between Margin Call and Memo Bank? You will understand.

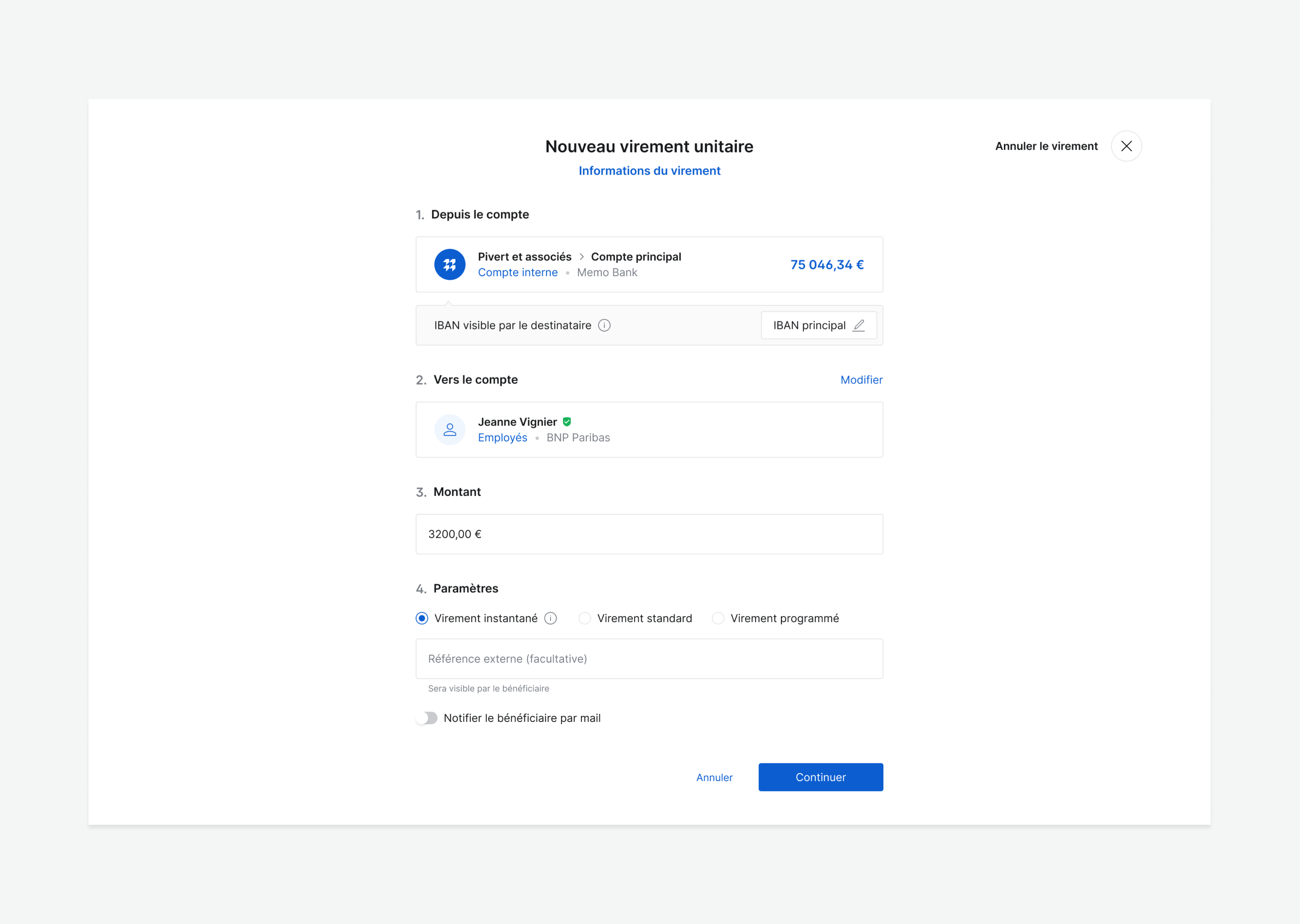

Starting today, all our customers have access to instant transfers, in addition to standard transfers. Instant transfers allow you to send (and receive) up to €100,000 (per transfer), 7 days a week, 24 hours a day. Think of it as the equivalent of SMS or e-mail, but for bank transfers: the delivery time no longer exists, or almost, since the transfer arrives at its destination in just a few seconds.

For an instant transfer to work, both banks involved in the transfer must support instant transfers, that is, both the sending and receiving bank must have done the work necessary to handle these types of transfers especially. Good news for SME managers: in France, the vast majority of traditional banks already support instant transfers. Which means you can send funds from a Memo Bank account to a BNP or Crédit Agricole account, in 10 seconds, starting today.

Back to Margin Call. How to impose the difference of Memo Bank on the instant transfer market? First question: do we want to cheat? The answer is clearly no. Second question: are we smarter than our competitors? We don’t have that pretension, no. So what can we do to find a place in the sun? Answer: we can be the first to offer instant transfers… at no extra cost… and with a limit of €100,000 (per transfer) — the regulatory maximum.

All traditional banks already offer instant transfers, of course, but almost all of them charge around €1 per instant transfer — with the exception of Banque Postale. By removing this “tax” on instant transfers, and allowing you to transfer up to €100,000 in 10 seconds, we are the first to arrive on the market for instant transfers at no additional cost and capped at €100,000.