To make banking data available everywhere, not only on banks’ websites, the European commission came up with a legal framework that banks must comply with. The revised Payment Services Directive (that you may as well just call PSD2) is part of that legal framework. To comply with PSD2, banks have to create APIs, that is machines-readable communication interfaces. Those standardized APIs are then used by regulated companies, called third party providers (TPP), that create connectors between banks (like Memo Bank) and accounting software (like Quickbooks).

As a business owner, you benefit from PSD2, because you get a secure way to fetch your transaction history from various apps—for free basically. No need to do crazy things to use your banking data outside of your bank: there’s a whole legal framework that promotes collaboration between banks and software companies to turn the notion of open banking into real benefits for business owners. You just need to add your bank account to the tools you are using and then authenticate the connection on your bank’s website. And that’s it.

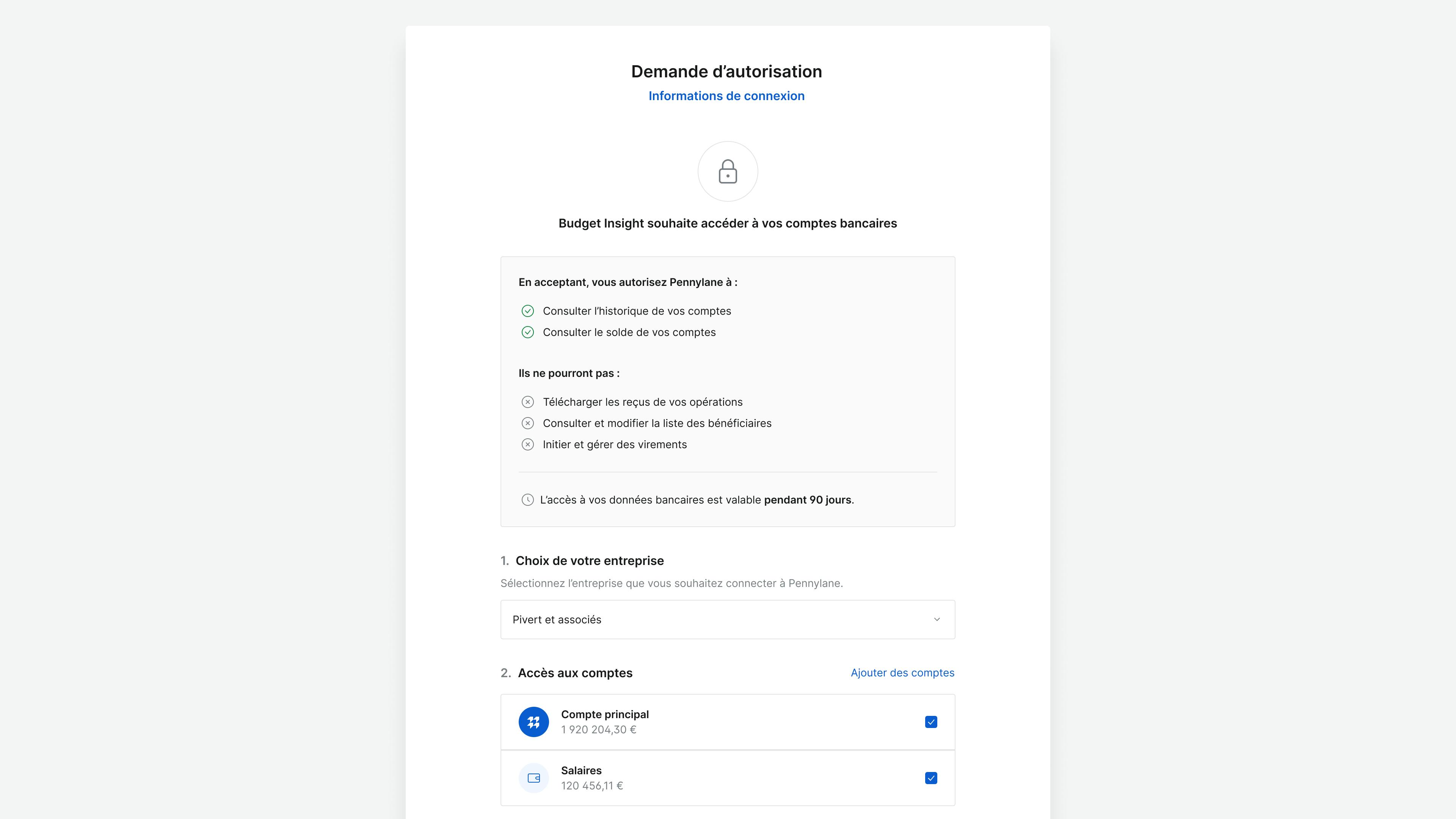

Since Memo Bank is a bank, we have to comply with PSD2. That’s why we maintain an API that allows us to be connected to two French TPP, Bridge and Budget Insight. Since Bridge and Budget Insight are connected to dozens of accounting tools, you can take advantage of that network effect to connect your Memo Bank account to your favorite tools. After all, that’s the whole point of PSD2: once a bank is connected to a TPP, the bank’s clients can sync their banking data with tons of third party tools.