A few weeks ago, we received two pieces of good news. The Prudential Supervision and Resolution Authority (ACPR), the body that regulates banks in France, has given us approval to obtain a credit institution license, thus making us a bank. In parallel, the European Central Bank (ECB), which supervises banks at the European level, has also given us the green light, thus recognizing our status as a bank. The discussions we had with the regulators went very smoothly, and we thank them for their trust. We are the first independent bank to emerge in France in 50 years, and we understand the responsibilities that this entails.

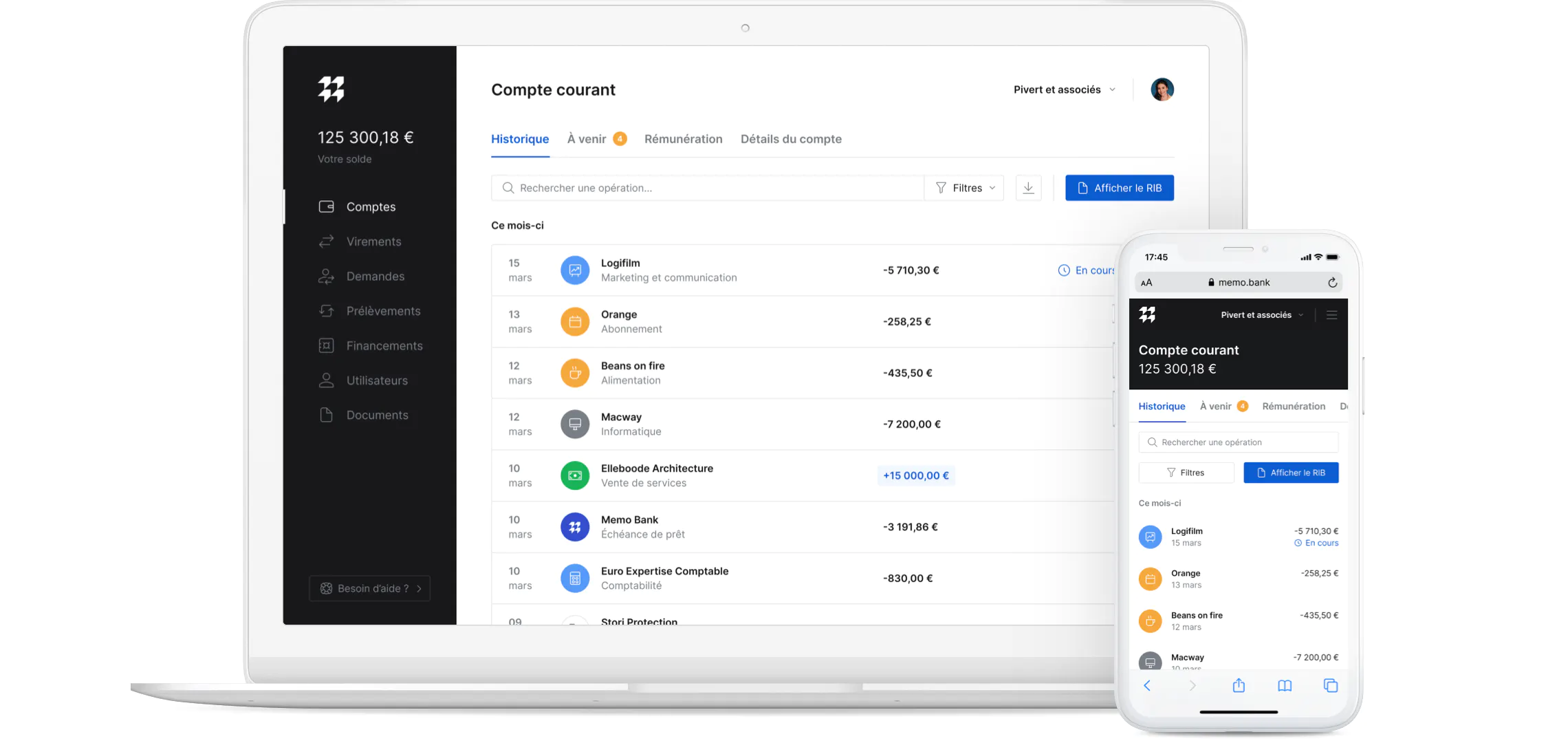

As the name suggests, the credit institution license will allow us to offer loans to our customers. In addition to offering financing, we will also provide deposit facilities, such as current accounts, and payment methods, such as IBANs. We want to help business owners manage their payments, receipts, and cash flow, but we also want to support them in financing their projects by offering the expertise of our frontline bankers. We want to be the bank for SMEs, the one for the CAC 140,000 — France had 138,700 SMEs in 2017 according to INSEE.