Memo Bank for finance departments

Optimising the WCR. Growing surplus cash. Reducing risks.

Are you looking to minimise your liquidity gaps? Eliminate time-consuming processes? Reduce your fees and risks? Digitise your expense management process? You have come to the right place.

Optimise your liquidity

Collect your payments within 24 hours

Are you tired of transferring funds between your SEPA payment solution and your bank? Memo Bank’s solution features an integrated SEPA payment solution, enabling you to collect your payments directly into your bank account within 24 hours.

Manage your liquidity

You can allocate balance levels across your accounts across held in different banking institutions through instant transfers. You can also use our banking API to define and automatically transfer balances across each of the accounts held with Memo Bank.

Segment your financial flows

Create as many current accounts and virtual IBANs as you need. Fine-tune the segmentation of your financial flows and simplify bank reconciliation operations.

Reduce your liquidity gaps

Benefit from a 30-day advance on expenses with our corporate cards featuring deferred debit. Also, enjoy overdrafts of up to €500,000

Maximise your surplus cash

Take advantage of interest-bearing current accounts and term deposit accounts that do not penalise partial or full withdrawals. At Memo Bank, the opening and management of a term deposit is done online.

Automate your transactions

Eliminate time-consuming processes and costly errors by fully automating your incoming and outgoing payments through our multi-award-winning Premium Bank API.

Delegate your tasks with peace of mind

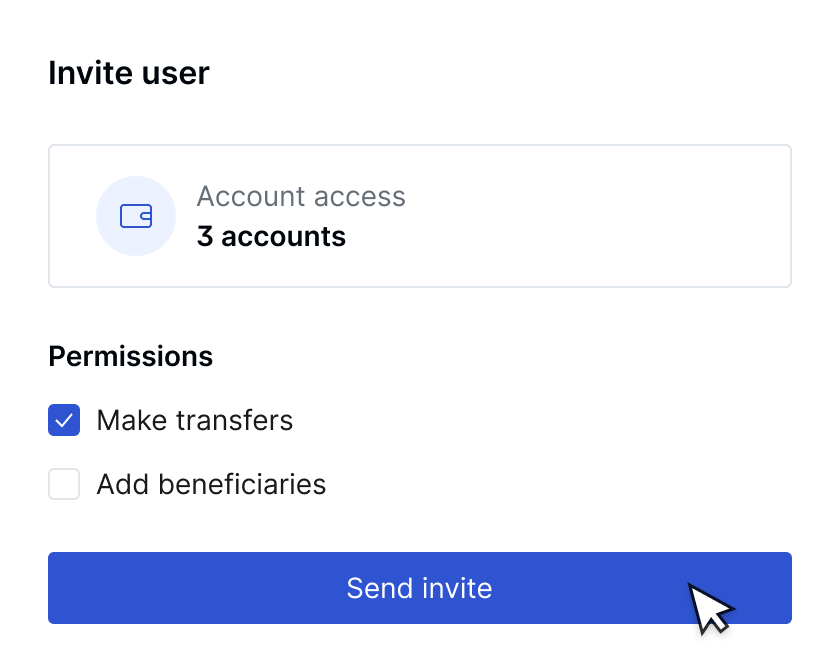

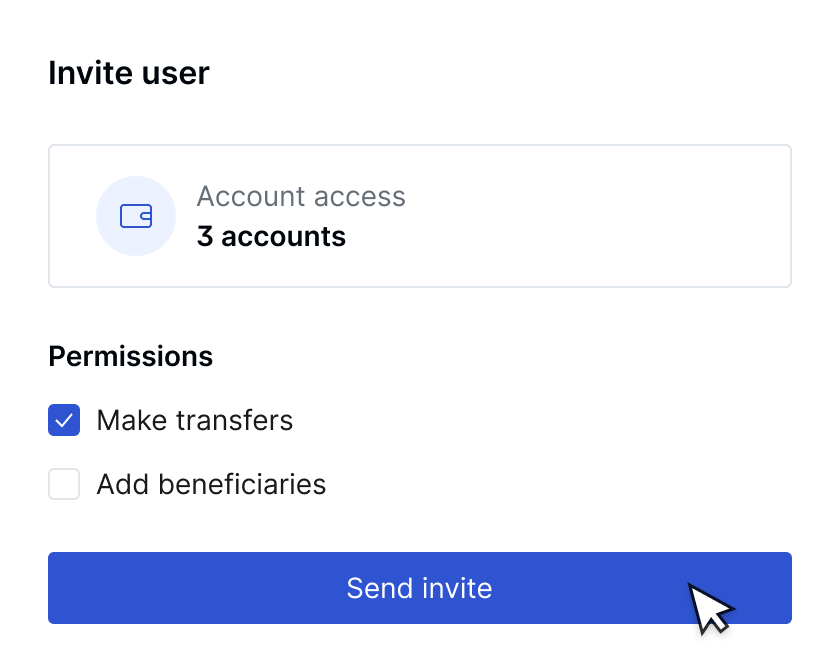

Define customised levels of access

With Memo Bank, you have full control over each of your employees’ access to your company’s bank accounts. Instantly create, modify, or revoke permissions.

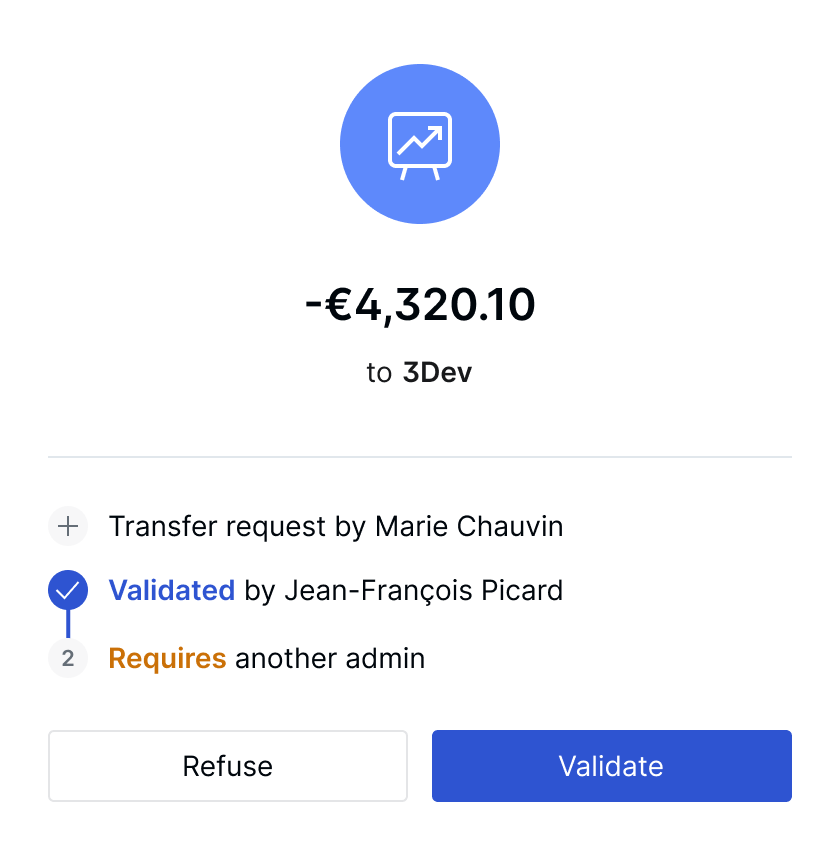

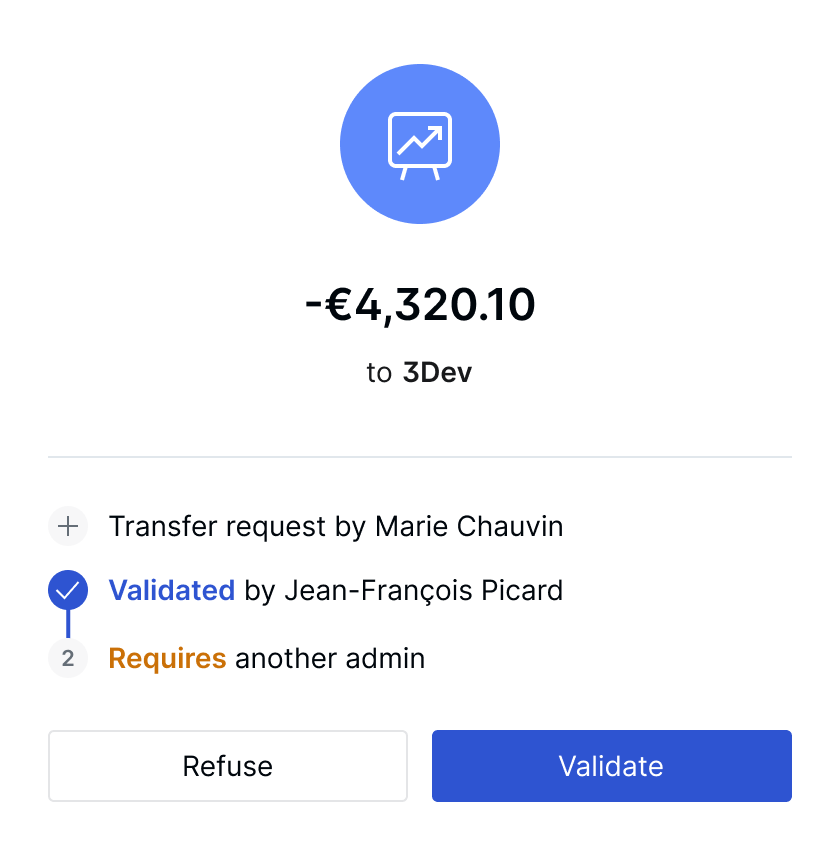

Delegate payment processing

Delegate the payment processing to your teams, and approve the transaction before its execution. You will receive a notification every time a payment is about to be made : no funds will leave the current account until you approve the transaction. You can also create more complex validation rules based on amount levels and user profiles.

Streamline the expense management process

Eliminate banking fees volatility

Memo Bank eliminates the uncertainty associated with banking fees. Our billing is fixed and set up monthly. No more variable fees linked to the value of your transactions. No more transaction commission negatively impacting your balances.

Manage employee expenses

For each employee, generate and configure virtual or physical cards, personalised and compatible with Apple Pay and Google Pay. Segment, track and manage each of your employees’ card expenses in real-time. Add your receipts from your Memo Bank mobile app or from our platform.

Meet your financial obligations

Don’t dip into your liquidity days in advance to meet your payments on time. Don’t put up with additional costs or low limits for issuing your instant payments. The default position at Memo Bank: standard SEPA credit transfers are processed much faster than the rest of the market, and instant SEPA credit transfers up to €100,000 are fee-free.

Mitigate your financial risks

Identify and validate sensitive transactions

There are no trade-offs when dealing with security. You’ll receive instant notifications on your mobile to validate or to decline a transaction which requires your approval. Through our real-time capabilities, you can identify the status of each incoming and outgoing transaction, giving you the opportunity to detect any suspicious activities or potential errors on your accounts before any damage is done.

Block any outgoing payments from your accounts

With Memo Bank, you can prevent direct debits from happening on any IBAN. You can also create virtual IBANs to reduce your risk exposure.

Track your card expenses in real time

Payments made with a Memo Bank card are displayed in real-time in two places. First, on the cardholder’s phone with a push notification. Second, on your Memo Bank account. No delays—track spending within seconds.

A company thrives through its teams

Our solution caters to the needs of finance, accounting, and management functions, benefiting every facet of your company. Its benefits extend to all teams within the company.

CEO and Executives

All services of Memo Bank are based on speed.

Accounting departments

All services of Memo Bank are based on speed.

Paul Morlet

Founder and CEO of Lunettes pour tous