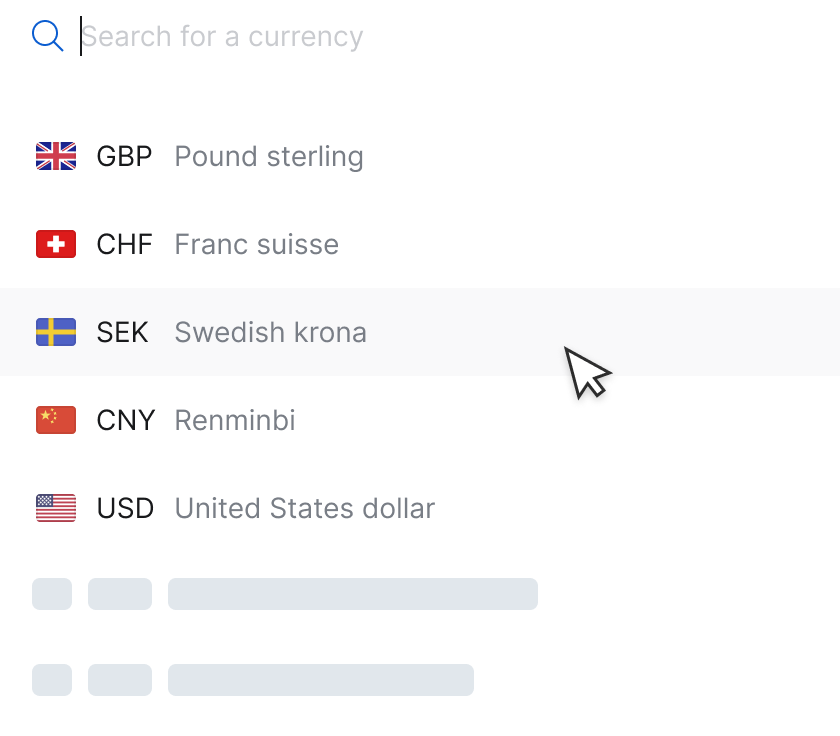

Your Memo Bank account enables you to make payments in 102 currencies and receive payments in 29 currencies (check our list of supported currencies).

We’ve partnered with J.P. Morgan to provide you with competitive exchange rates when your business makes or receives international payments

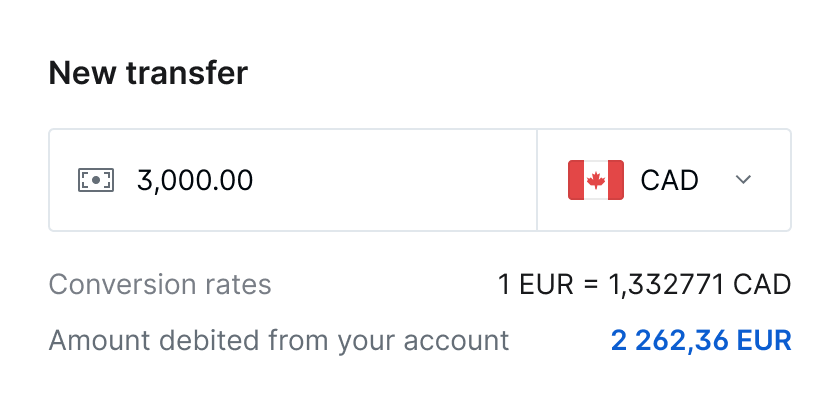

At Memo Bank, we're crystal clear about our fees. Our pricing is based on a fixed processing fee (€7.20 excl. VAT for each international payment, whether received or sent) and a foreign exchange fee which ranges from 0.75% to 1.20%, depending on the currency being converted.

The execution of international payments can take a few hours, and exchange rates may vary during that period. We'll cancel your transfer if the exchange rate increases by more than 10% during that window.

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed