Our pricing plans are all based on a fixed tariffs that are set in advance and billed monthly. The value of your payment collection does no impact the pricing, only the volume of collections does. The volume is set by you and you can change it at any time.

Your WCR is no longer subject to the pressure imposed by your fintechs and banking partners. At Memo Bank, your bank account is credited within 24 hours for collection instructions initiated before noon (48 hours otherwise).

You can manage your payment collections directly from your Memo Bank account: volume of payments, recurrences, due date, etc.

You can fully automate the SEPA collections of your payments with our unique and multi-award-winning banking API.

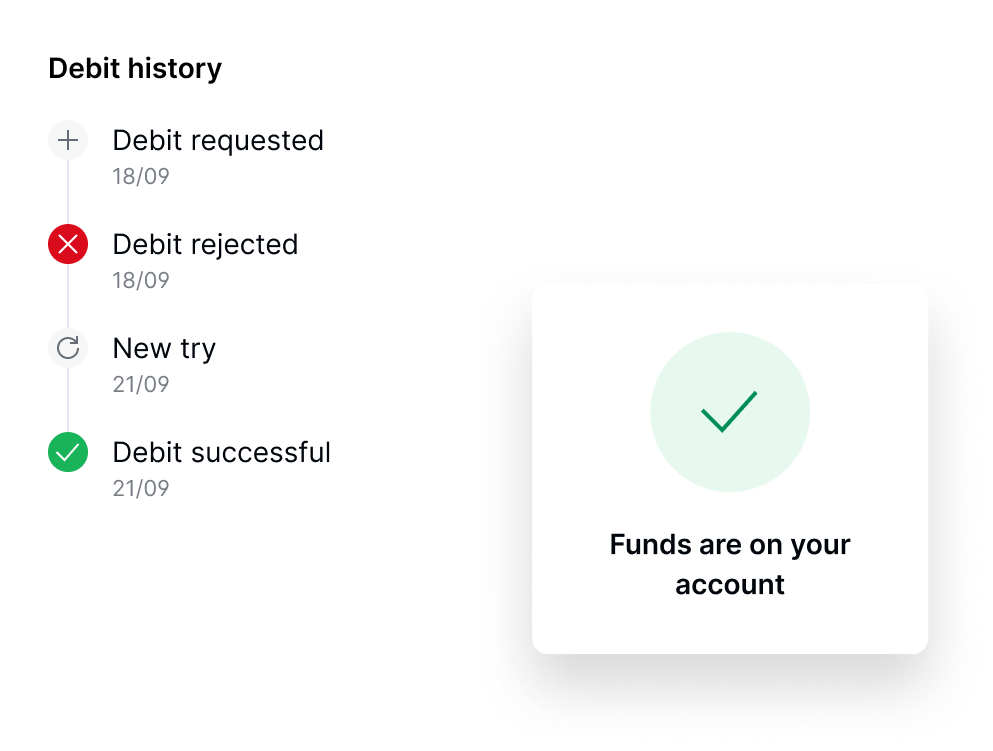

Either from your Memo Bank account or via our banking API, you can track in real time the status of your incoming transactions. If a payment collection is rejected, you can access the reason behind the failed transaction (R-transaction).

14.6% of online card payments are declined (Banque de France). Our solution allows you to collect payments from your customers by directly debiting their current account. Additionnaly, you can automate payment retries for failed transactions. SEPA direct debits enable you to maximise your debt collection recovery rates and minimise admin tasks dedicated to monitoring your accounts receivable.

To fulfill your financial obligations towards your clients, suppliers, etc. you can pay your creditor via SEPA direct debit. The SEPA direct debit is then carried out in a secure manner. You can dispute a direct debit, either by challenging each debit or by revoking the entire direct debit mandate.

As your transactions are tracked and visible in real-time, you can act quicly if you detect any errors on your SEPA payments (wrong or unknown recipients, unusual amounts, suspicious transactions, etc.).

Neutralise the risk of fraud. Through our available functionnalities, you can prevent any outgoing payments from leaving your account.

Services and technologies

50 employees

50 employees Paris (75)

Paris (75)Computer equipment

20-49 employees

20-49 employees Paris (75)

Paris (75)Fintech

20 employees

20 employees Paris (75)

Paris (75)Discover how our clients accelerated their development with Memo Bank

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed