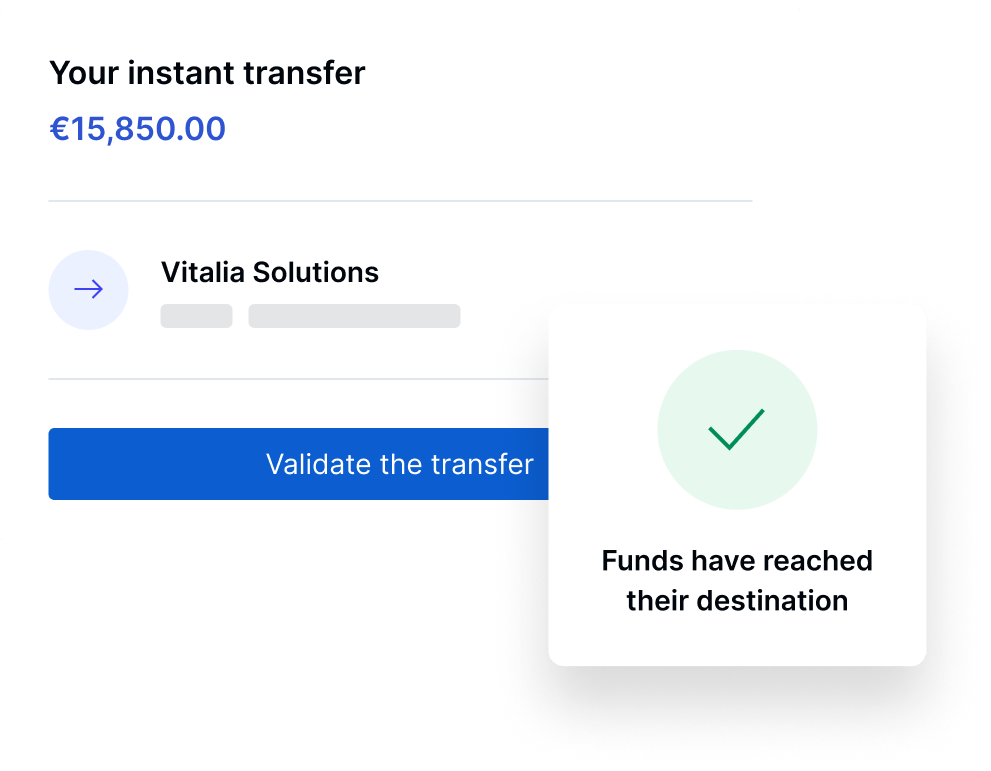

At Memo Bank, making SEPA instant payments is not a chargeable service, but rather the standard way to make payments, unlike traditional banks.

You can make SEPA instant credit transfers of up to €100,000, which represents the highest limit set by the European Central Bank.

Our standard transfers are the fastest in the market. The funds will be credited to the recipient's account on the next working day at the latest. If you submit the payment instruction before 3.30PM, the funds will be deposited into the recipient's account on the same day.

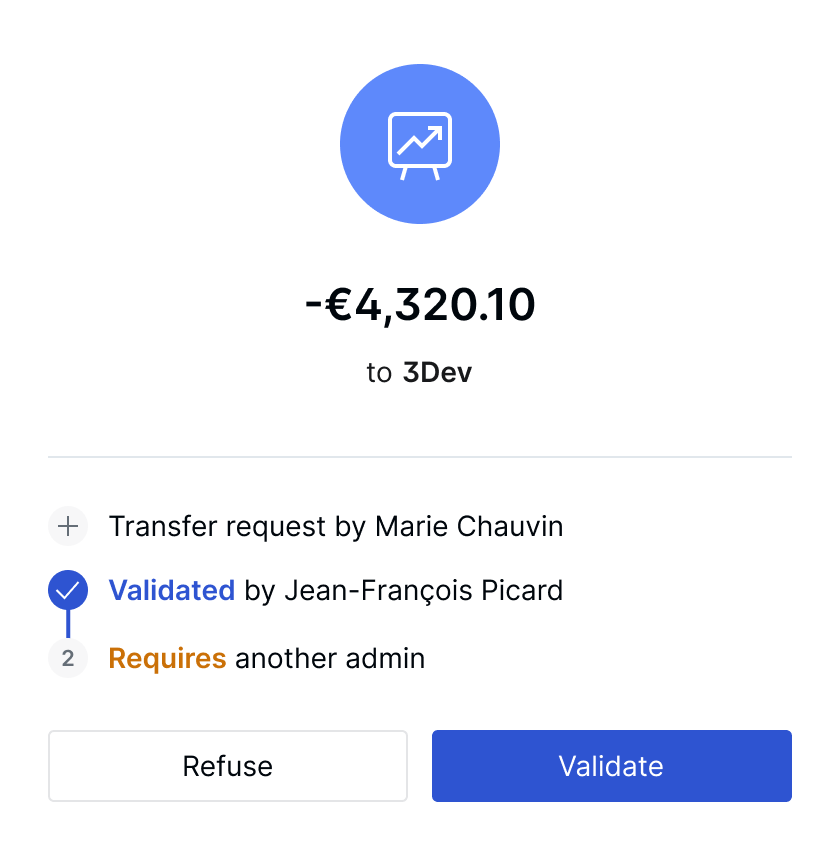

Create validation rules for your transfers. Do you want to let your team members issue SEPA transfers up to a certain threshold that you can set in advance? It's possible. Do you want to approve SEPA transfers exceeding a certain threshold? That's also possible.

No need to wait ages to make a transfer to a new recipient: adding new recipients and transfering funds to them takes just a matter of seconds.

We want you to be able to anticipate your banking fees, together with being able to reduce them. For these reasons, our pricing is fixed. There are no variable fees based on the amount to be transfered, nor any transaction fees on your current account. Our billing is monthly and known in advance.

Costly errors, time-consuming file manipulation, difficulties in reconciling payments are certainly part of your daily life when managing your transfers. These challenges are addressed through our banking API. The entire outgoing payment flow is automated: scheduling outgoing SEPA transfers, receiving real-time notifications, as well as importing and adding supporting documents to your transactions.

The reconciliation of your transfers become easier and faster with virtual IBANs. These virtual IBANs are not physical accounts, but are directly linked to your current account(s). By assigning different virtual IBANs to your clients and making your outgoing transfers from these IBANs, you can easily identify the origin and the destination of each transfer.

When making SEPA instant credit transfer, your funds can leave the account just a few seconds before the paiement due date. You no longer need to dip into your cash reserves too early or incur charges when making SEPA instant payments.

If you have multiple current accounts with us, our banking API will help you distribute your balances across your accounts according to targets that you can set.

Environment

50-99 employees

50-99 employees Paris (75)

Paris (75)

Software

20-49 employees

20-49 employees Lyon (69)

Lyon (69)Computer equipment

20-49 employees

20-49 employees Paris (75)

Paris (75)Discover how our clients accelerated their development with Memo Bank

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed