As of 28 april 2025, the annual interest rate on the Booster Account amounts to 1,73 %. This rate is effective from the first euro. No need to be a large corporation to earn a competitive interest rate.

The Booster savings account gives you total flexibility over your liquidity. Add or withdraw funds instantly and autonomously. No conditions on the minimum amounts you can add or withdraw.

As soon as you become a Memo Bank client, opening the Booster Account takes just seconds, and is managed directly from your banking platform. At Memo Bank, you'll never go through outdated procedures or administrative burdens to open an account.

The competitive level of interest rate paid on the Booster Account is not the result of investments made on financial markets. Hence, the level of volatility on your returns is reduced, and your deposits are protected.

The interest is calculated daily and is based on the minimum daily balance on your Booster Account. Interest is paid out monthly.

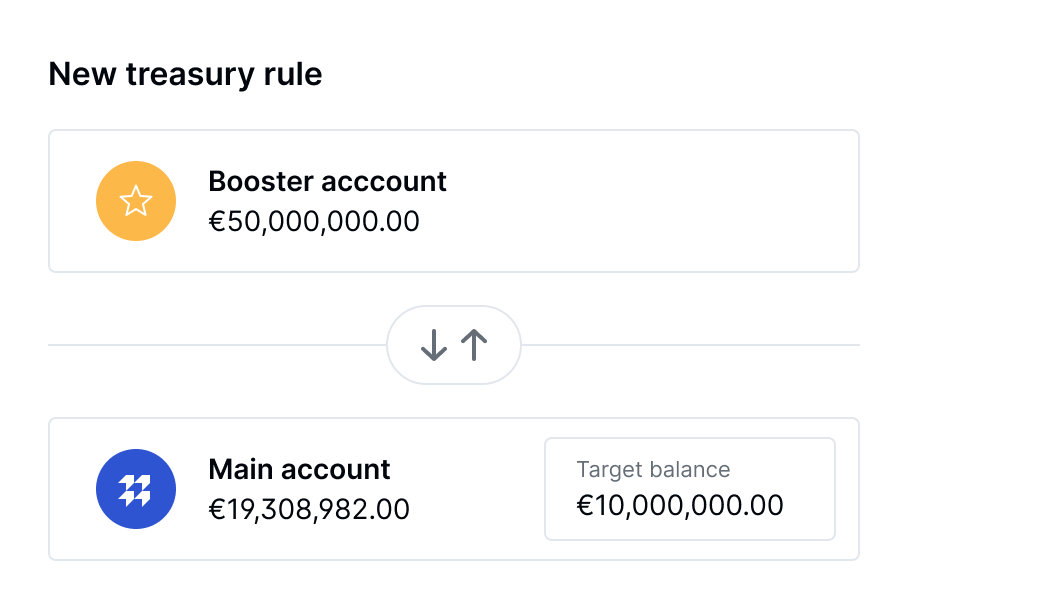

Maximise returns earned on the Booster Account or manage unforseen circumstances by setting up your own cash sweeping rule. Instant balance transfers are made between your main current account and your Booster account according to your cash sweeping rules.

The interest rate on the Booster account tracks the Euro Short Term Rate (€STR), the daily euro reference rate calculated by the ECB. Calculated daily, the interest rate is set at 80% of the €STR. Memo Bank maximises the return earned on your cash surpluses. Memo Bank reaffirms its commitment to supporting all businesses, especially in a challenging economic context.

Memo Bank has been implementing concrete and impactful actions to minimise its impact on the environment. In parallel, Memo Bank continues to raise awareness among its clients and the entire banking sector about climate issues.

Through compliance with Basel III solvency ratios and other regulatory requirements, and a successfully audited state-of-the-art technology, be sure that your deposits are fully protected with us.

The Booster Account is part of a wider range of interest bearing accounts. Our range includes the instant access Booster account as well as our money market funds, liquid within 24 hours and offering an interest rate correlated with the €STR, and our time deposits allowing for partial and full withdrawals with 32 days' notice.

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed