You know in advance the maxilmu limit of your overdraft, its duration and its interest rate. These elements are put in your contract and can be reviewed at any time

Nobody knows if unforseen circusmtances are going to happen, let alone when. To take the guesswork out of the equation, the maximum limit of your ovedraft is set in advance and can be as high as €500,000.

Most overdrafts play hard to get, only sticking around for 6 months to a year. Ours is granted to you for as long as you require it, with no fixed duration. You decide when to revoke it.

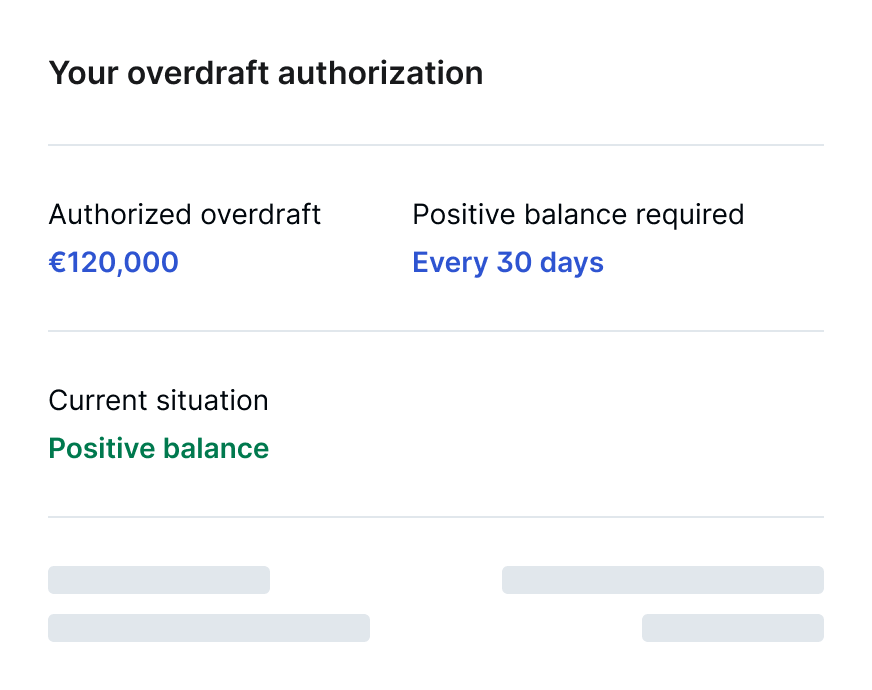

Our overdraft authorisation is valid for 15, 30, 45, or 60 consecutive days. Hence, your current account can be overdrawn for up to 2 months before reaching a positive balance.

We will not require any form of guarantee to give you an overdraft authorization. We trust you, which enables us to address your needs more quickly.

You take us through your needs and the details of your business. We'll then review the information and the documents you've shared.

If we believe we can assist you, your relationship manager will shcedule a meeting with you to gather additional elements.

Once we confirm we can provide you with an overdraft facility, you'll get to e-sign all the documents and start using your overdraft right away.

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed