Memo Bank current account:

the foundation for your business in France

The Memo Bank current account: the foundation for your business

The best way to manage

all your banking needs in one place.

A remunerated current account with no transaction commission

The interest paid on the current account tracks the €STR, the daily euro reference rate established by the ECB. This interest rate is set at 10% of the €STR and is paid out monthly. Unlike other French traditional bank, we don’t charge our clients with the transaction commission.

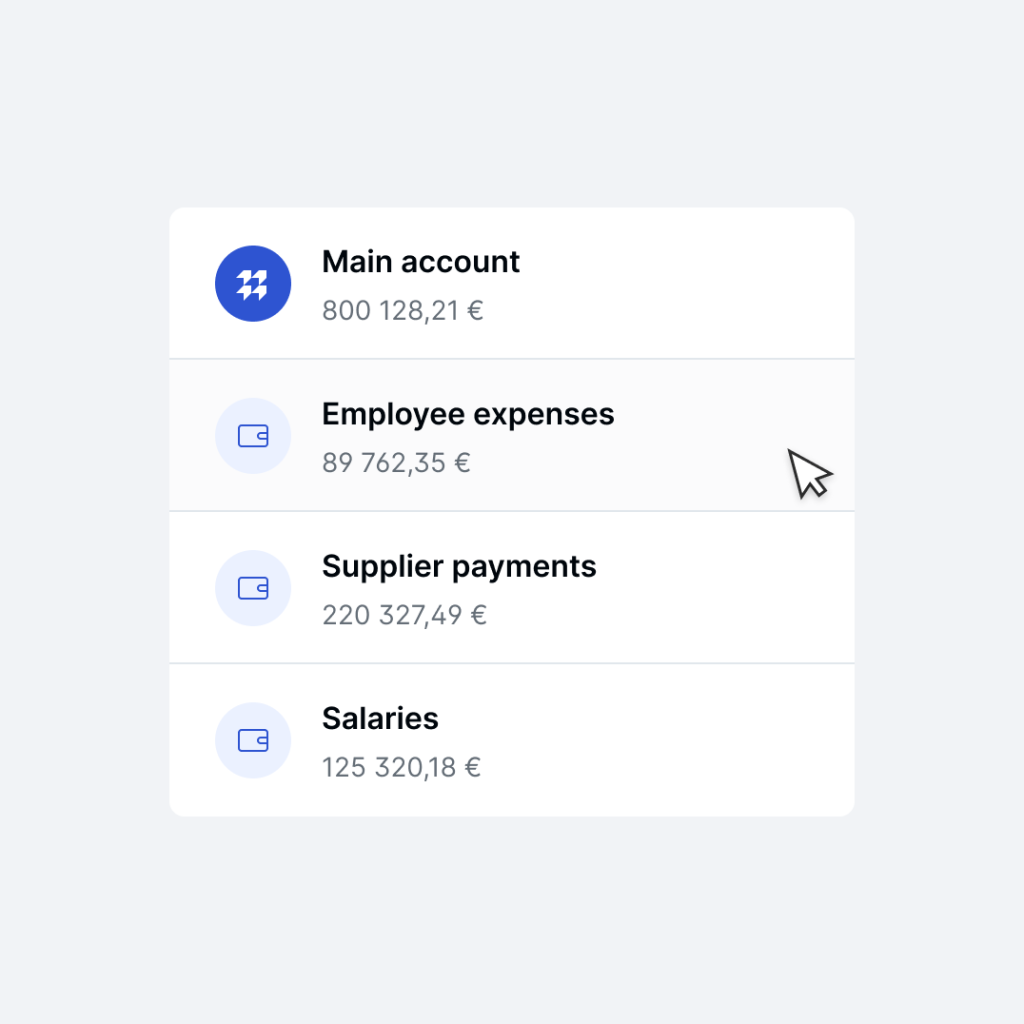

An expandable current account

You can create as many current accounts as you need. Each current account has its own French IBAN. You have an aggregated view of all your accounts. Your finance teams and accounting teams can then segment banking operations by business unit, clients, suppliers, type of expenses, etc.

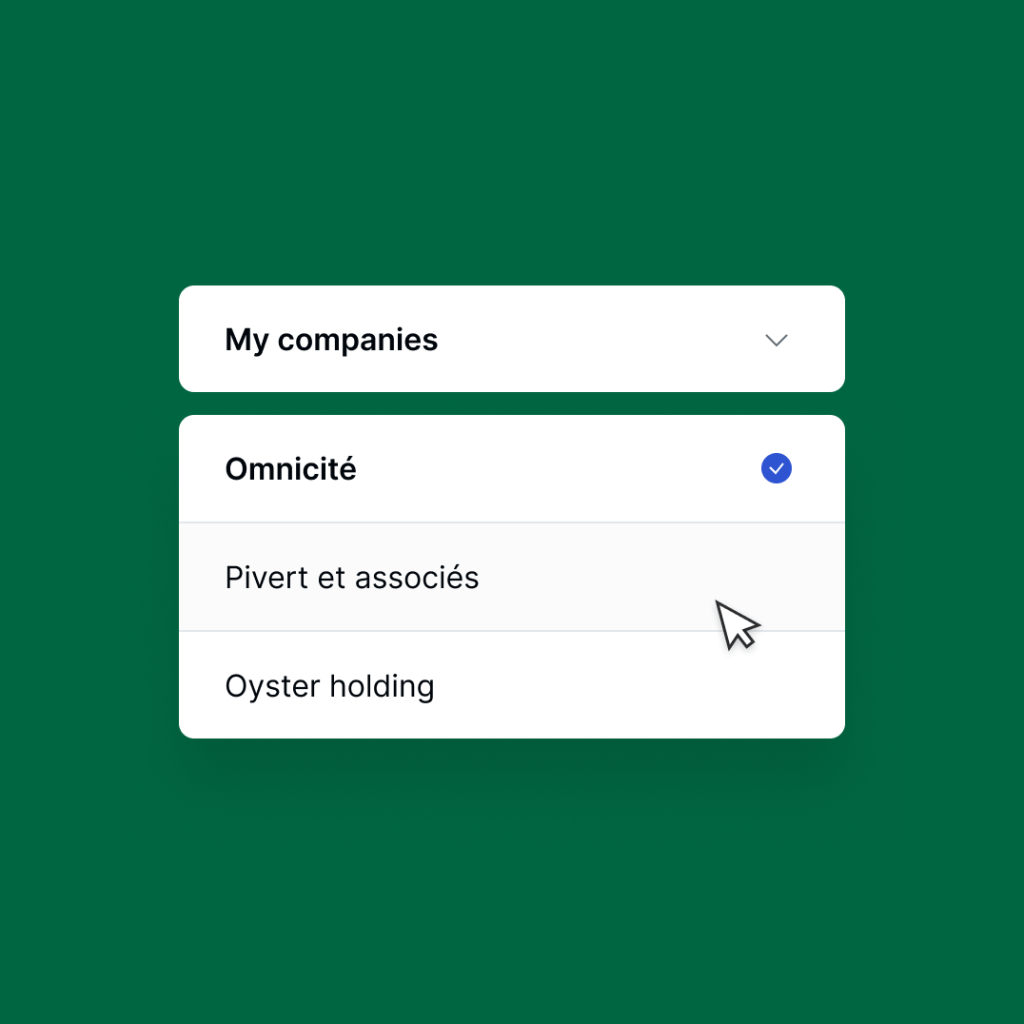

A unified multi-accounts experience

Are you interested in opening accounts for the parent company and its subsidiaries in France? With Memo Bank, you can access the accounts of your main company and its subordinate entities at the same time. Our clients enjoy using single log-in credentials to access all the accounts associated with their company.

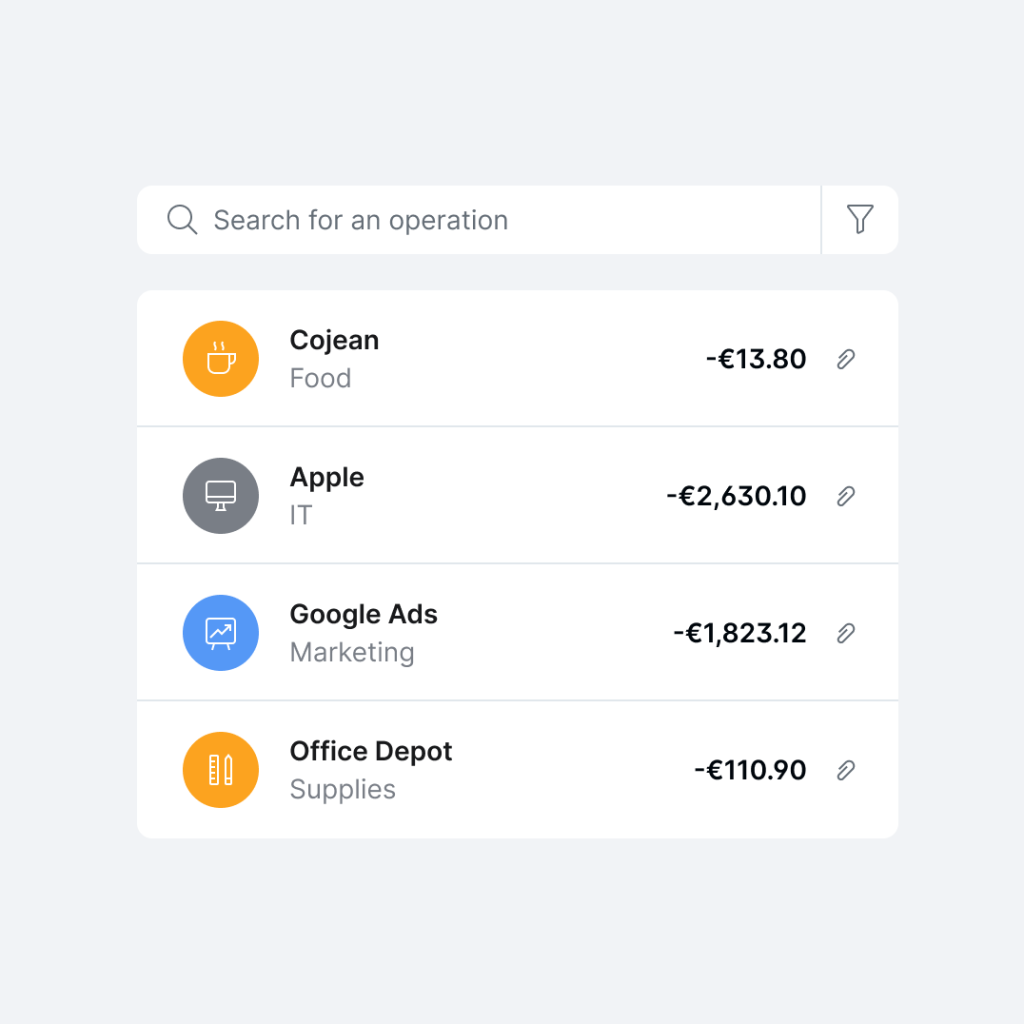

An account with easy-to-read records

Access to past and current transactions in just seconds. Group together and assign predefined labels to your transactions. Your accounting and finance teams will enjoy accessing and analysing the activity within the account.

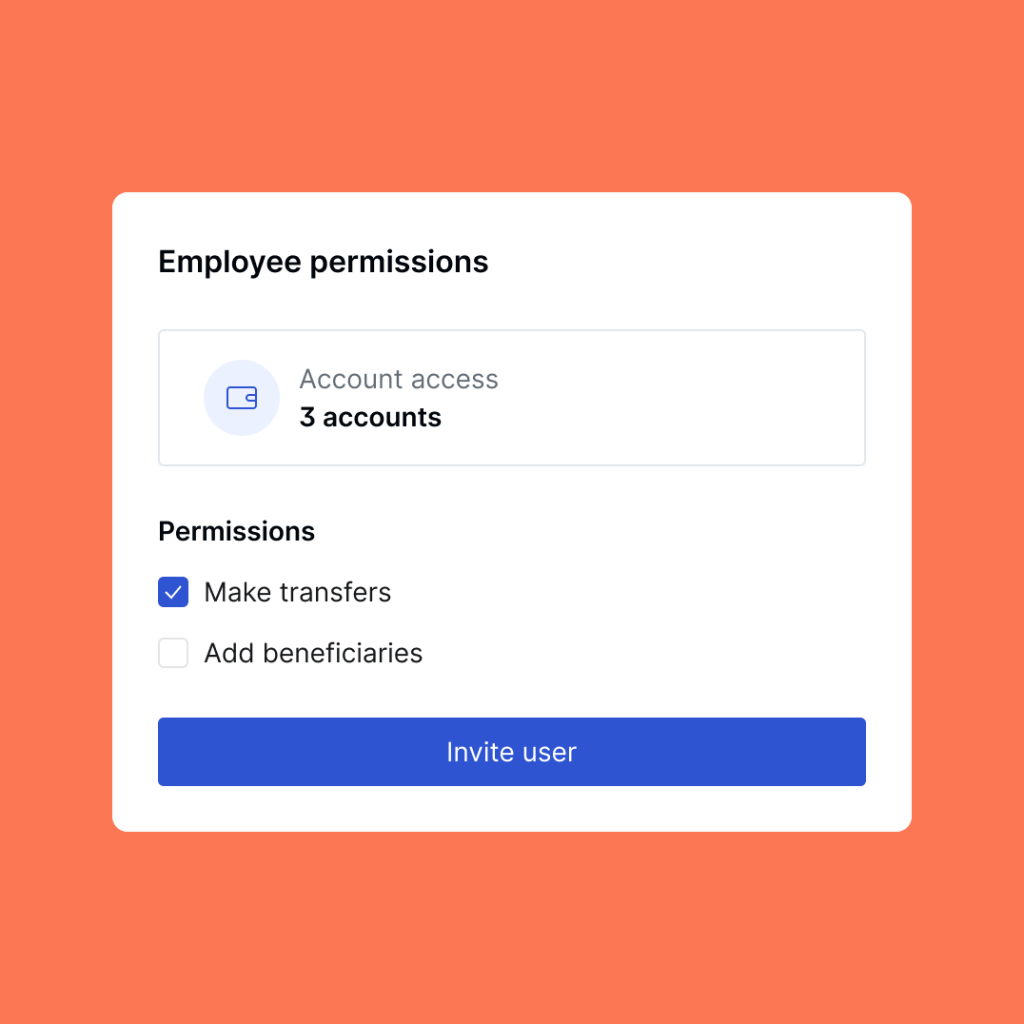

An account that empowers your teams

The Memo Bank current account is tailored for finance and accounting teams, with functionalities that make a significant impact on the entire organisation. Tasks can be delegated according to rules that you can set: team member details, level of control given when carrying out a task, etc. You can define as many delegation rules as you want and update them as often as you need.

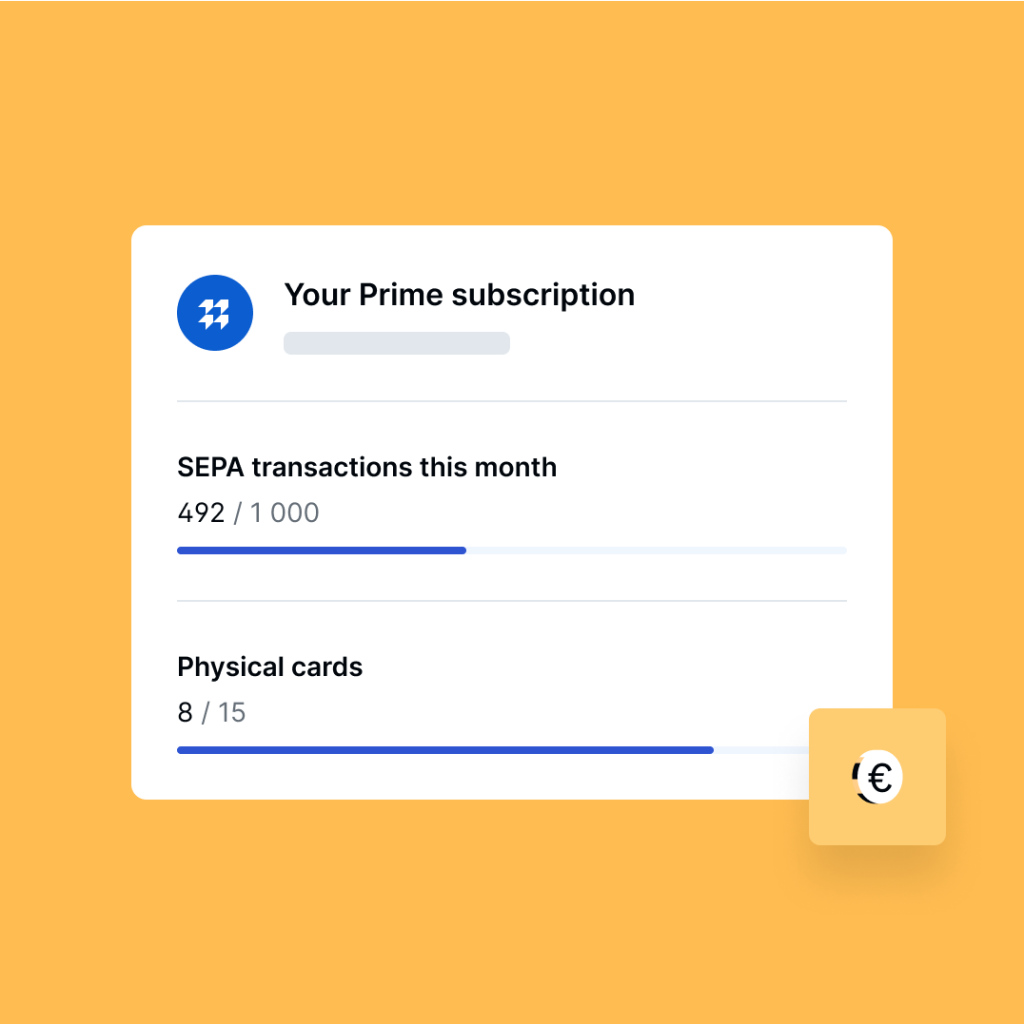

Strong foundations for managing your company's everyday operations in France

-

Interest earned set at 10 % of the €STR

-

No transaction commission

-

Execution of single or grouped transfers

-

Unlimited transaction history and real-time tracking of your operations

-

Filters to search and group together banking operations

-

Additional current accounts with French IBAN

-

Separate current accounts for the parent company and its subsidiaries

-

Bespoke delegation and authorisation rules

-

Interface available in English and French

Businesses like yours choose to bank with us. What about you?

Memo Bank transforms the way businesses manage their finances. We deliver a great and unique experience to all business alike: quick and easy account opening, help in switching your other accounts to us, dedicated relationship managers, cutting-edge technology, and facilitating access to loans.