Your deposits are safe

Through its regulatory ratios, governance, and climate strategy, Memo Bank continues to demonstrate its exceptional standards as a rock-solid and responsible bank.

A solid bank

Memo Bank is built on strong foundations: authorised as a credit institution by the ECB and regulated by the ACPR, with strong regulatory ratios and a healthy balance sheet.

Memo Bank: An independent and regulated French bank

Memo Bank is an independent bank offering credit, deposit and payment services. Memo Bank is authorised as a credit institution by the ECB and regulated by the ACPR (Banque de France). We are subject to the same regulatory requirements as other French banks.

Successful external audits

Our balance sheet, financial statements and reports are audited annually and approved by KPMG. Additionally, our core banking technology has been successfully audited by Synacktiv and 247cyberlabs. These audits confirm the strengths of our balance sheet and our systems.

Corporate governance

Our supervisory board consits of well-renowned and highly experienced individuals, all from the banking and investment world. Two supervisory board members are from Bpifrance, the French public investment bank. Ronan Le Moal, former director of Arkéa bank, is the board chair.

Outstanding financial perfomances

In 2024, our balance sheet doubled and our Net Banking Income increased by 35%. More than 700 SMEs and mid-sized companies trust us to manage their deposits. Access our annual reports

A strong balance sheet

Your deposits are fully protected with us, as evidenced by our strong Basel III ratios.

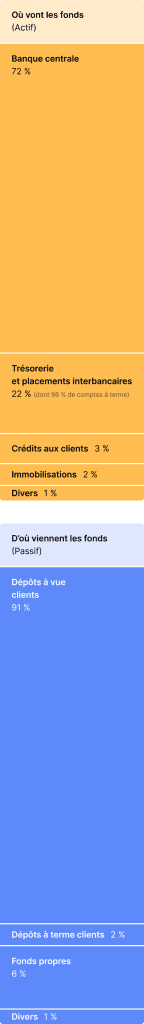

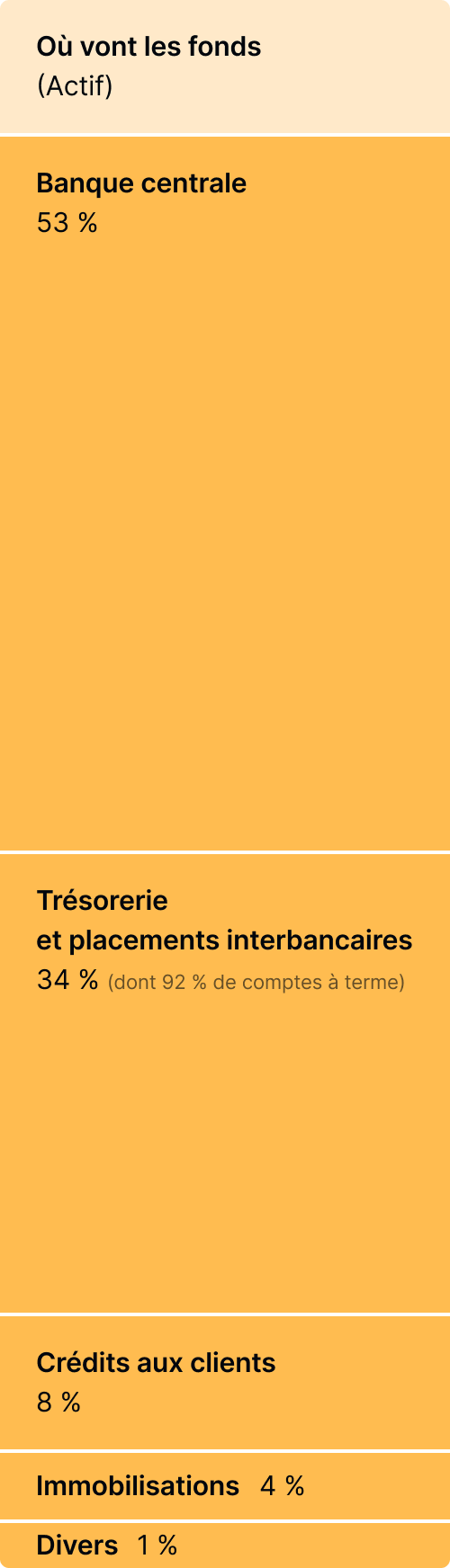

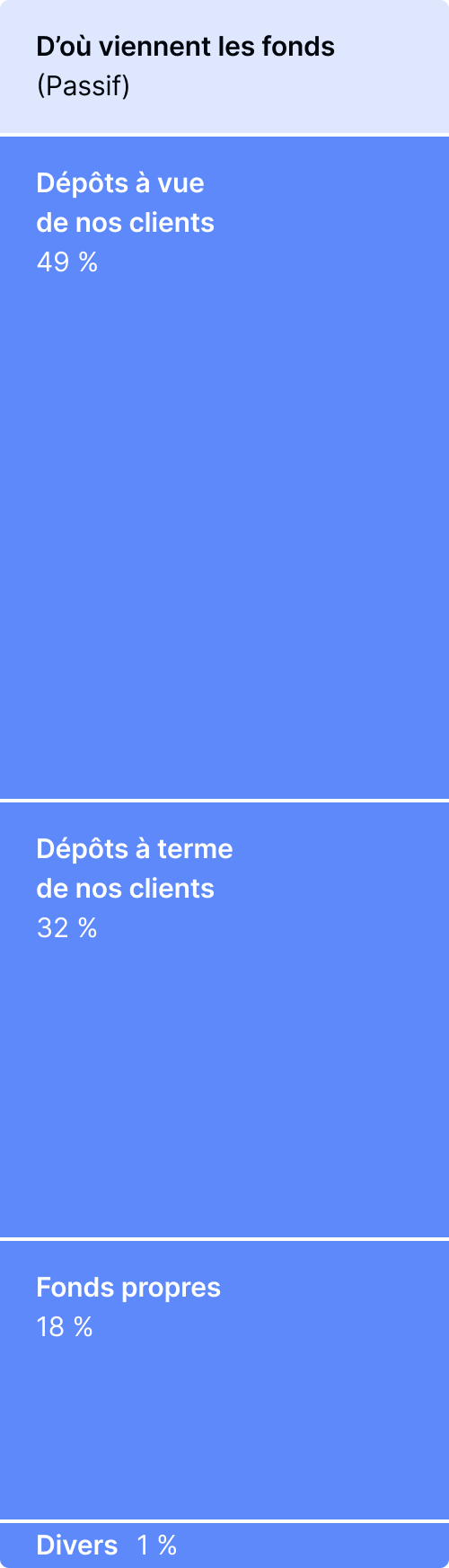

A healthy balance sheet

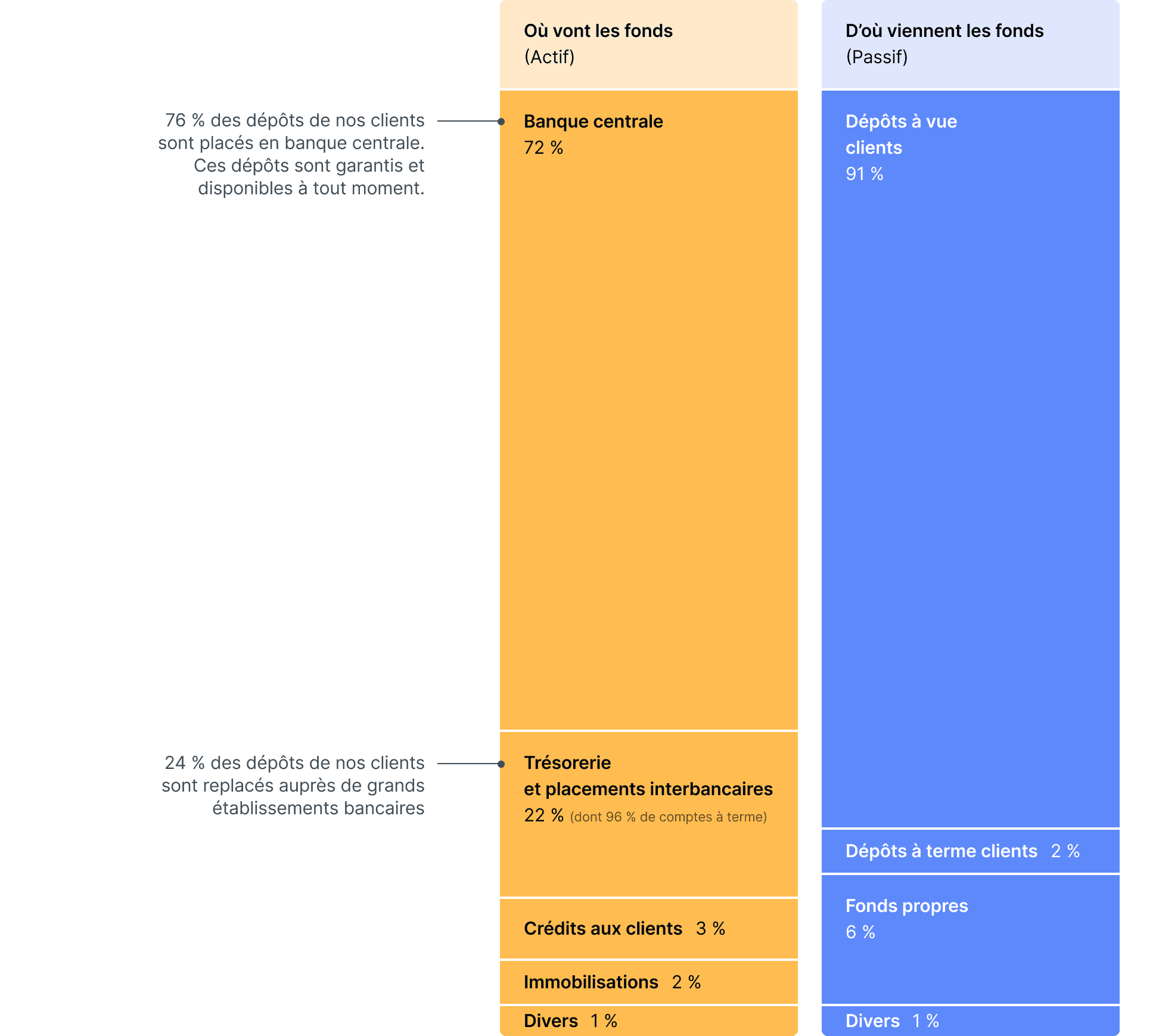

Memo Bank adopts a conversative approach when managing its clients’ deposits, reducing liquidity risk and giving clients complete peace of mind when banking with us. Our clients’ deposits are put directly with central banks or with large and well-renowned French banks. Our clients’ depoits are not invested in risky financial instruments.

65% of our clients’ deposits are kept in central banks. These deposits are accessible at anytime.

35% of our clients’ deposits are put with major French banking institutions.

Regulatory ratios well above Basel III requirements

Liquidity Coverage Ratio and Net Stable Funding Ratio — 2024

Regulators have defined liquidity ratios financial institutions need to comply with to ensure resilience of the entire banking system during standard and stress-tested economic conditions.

- The Liquidity Coverage Ratio (LCR) determines a bank’s ability to absorb an economic shock over a one-month period. Memo Bank’s LCR is 261%.

- The Net Stable Funding Ratio (NSFR) determines a bank’s ability to maintain a stable funding profile in relation to their assets and off-balance sheet activities over a one-year horizon. Memo Bank’s NSFR is 236%.

Liquidity Coverage Ratio (LCR)

Net Stable Funding Ratio (NSFR)

Regulatory thresholds

100%

100%

Memo Bank

261 %

236 %

Common Equity Tier 1 2024

The Common Equity Tier 1 (CET1) ratio evaluates a bank’s ability to absorb losses while continuing to operate without defaulting. This ratio measures the proportion core equity capital, defined as high-quality for a bank, compared to its risk-weighted assets. The CET1 ratio is used to assess a bank’s ability to absorb losses and withstand financial stress. Memo Bank’s CET1 is 27%.

Common Equity Tier 1 (CET1)

Regulatory thresholds

11.75%

Memo Bank

27 %

Average of the six major French banking groups (2024 – see the source)

15 %

Our climate strategy

Our clients’ deposits are not used to financing fossil fuels.

A transparent climate strategy

Through our actions, financing, and partnerships, we are leading the way to a low-carbon economy. We do not finance any activities related to fossil fuel projects. The carbon intensity of the loans granted by Memo Bank to its clients is nearly four times lower than the average of major French banks. Our clients’ deposits that are put in the European Central Bank have a reduced carbon footprint.