A banking experience that (finally) meets your needs.

You wouldn't even dare dream of it.

We did it.

Current accounts

Manage day-to-day transactions for your parent company, your subsidiaries and your teams. No transaction commission. Fixed pricing Interest-bearing current account.

Term deposit account

Manage your excess cash directly from your Memo Bank platform.

Open and manage your account online

Deposit up to €10 million

No penalties on partial or full withdrawals

No financing fossil fuels

Client accounts

In compliance with banking regulations, our client accounts ensure a strict separation between your funds and those held as intermediaries.

Settlement account

Ring-fenced account

Specially dedicated account for securitisation funds

French trust account

Meal voucher account

Automate your bank transactions

Eliminate time-consuming processes and costly errors with our banking API.

Automate the entire incoming and outgoing payment flow

Reconcile and segment your transactions with virtual IBANs

Manage your current accounts and client accounts

Be notified in real-time (webhooks) when a transaction happens on your accounts

Collect your invoices by SEPA direct debit

Collect your invoices in less than 48 hours.

Up to 8 days saved on your WCR

Fixed pricing with no transaction commission

Automatic retry for failed direct debit payments

Execute your SEPA payment collection via your Memo Bank account or our banking API

SEPA and Swift credit transfers

Instant SEPA credit transfer up to €100,000 and fee-free. Swift transfers available in more than 90 currencies

Corporate cards spending

Our cards solution enable you to track and manage your expenses in real-time while optimising your liquidity.

Save up to 30 days on your WCR with deferred direct debit cards

Uncapped payment thresholds.

Create nominative commercial cards online

Manage your employees' cards expenses online and in real-time

Nominative physical or virtual cards compatible with Apple Pay and Google Pay

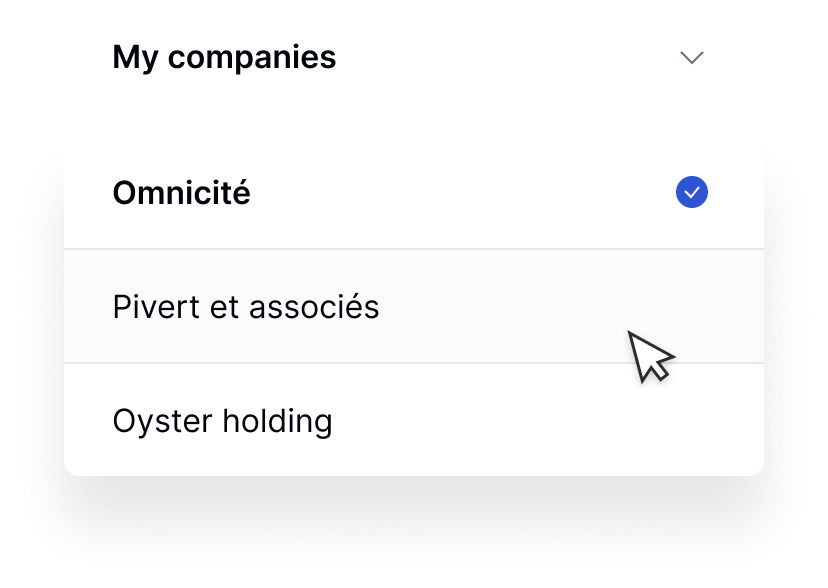

Managing accounts of the parent company and its subsidiaries

Create additional current accounts to segment and track your activity at a granular level. Manage and access all your subsidiary accounts that are held with us.

Preparing your bank reconciliation

Assign a virtual IBAN to a customer, a specific transaction, an internal department, etc. Your finance and accounting teams will then be able to accurately and swiftly identify and reconcile incoming and outgoing transactions.

Connecting your tools to your bank

Connect your accounting and treasury tools to your Memo Bank accounts via our Open Banking API.

EBICS TS (Interbank communications protocol)

Seamlessly transfer banking data between your own tools and your Memo Bank current account via EBICS, a highly-secure interbank communication protocol.

Overdraft

Memo Bank helps keep your business afloat during challenging circumstances.

Capital increase

Complete your capital raising process in a swift and efficient manner. As a regulated commercial bank, Memo Bank is authorised to issue a deposit certificate once the funds have been credited into the relevant account.

Medium and long-term loans

We give business loans to finance your tangible and intangible assets. We can also be involved in co-lending initiatives. You’ve come to the right place if you need to move quickly. We’re fast

The only bank that allows you to manage your needs in real-time

Find out how Memo Bank has transformed the daily lives of many businesses.

CEOs and senior executives

Partner with a bank that can assist you in implementing your strategy, delegating tasks, and mobilising your teams and business around your vision.

Financial department

End -to-end automation of your transactions. Your liquidity gaps are reduced. Protect and optimise your liquidity Our pricing is fixed and set in advance.

Memo Bank is a true partner, a bank that knows how to support us when we need it.

Jean-Sébastien Moroni

Chief Financial Officer

of Moroni S.A

Accounting departments

Your bank reconciliations are simplified. Your exposure to risk is reduced Streamline the management of your employees’ expenses. Connecting your tools to your bank is quick and easy.