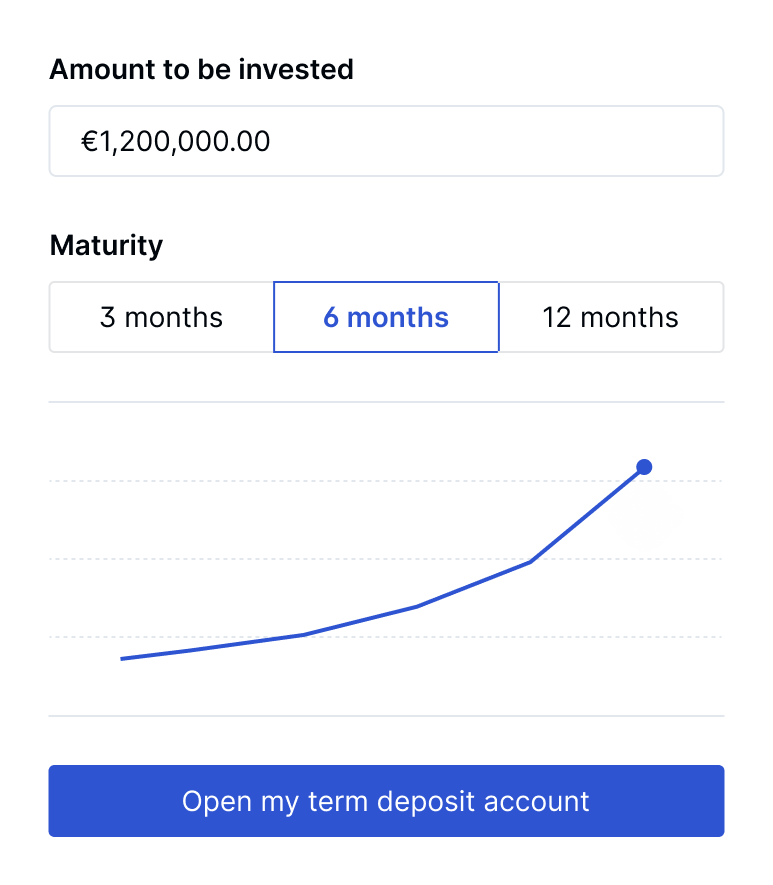

Opening our term deposit account can be done and e-signed online. It is a matter of a few seconds to open an account.

The remuneration of our term deposit account features stepped interest rates: the rate determined at the time of opening increases in steps until the term deposit reaches maturity. Our term deposit account is available in maturities ranging from 3 months to 24 months.

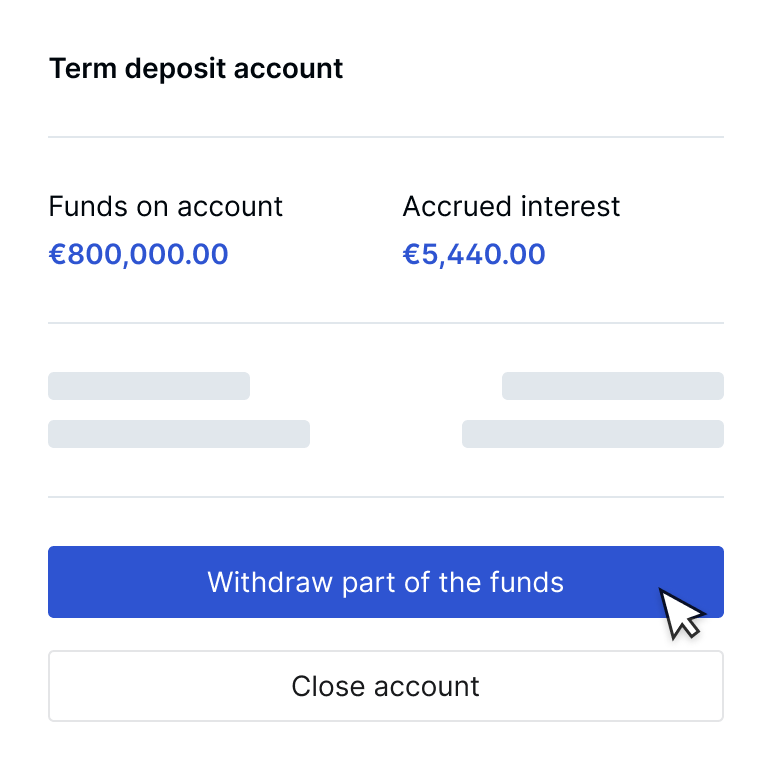

When making full withdrawals from the term deposit account, you won’t incur any penalty fees.

Unlike other term deposit accounts, ours do not require you to fully lock your funds. You can make partial withdrawals from our term deposit account by just giving 32-day notice

Your funds are protected. Our Liquidity Coverage Ratio (LCR), and Net Stable Funding Ratio (NSFR) are standing way above Basel III requirements.

We are not financing fossil fuels. Let’s be clear here: Memo Bank will never use your deposits, whether you put them in a current account or a time deposit account, to fund oil, gas, or coal initiatives.

20 employees

20 employees Paris

Paris

Telecom

16

16 Paris (75)

Paris (75)Discover how our clients accelerated their development with Memo Bank

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed