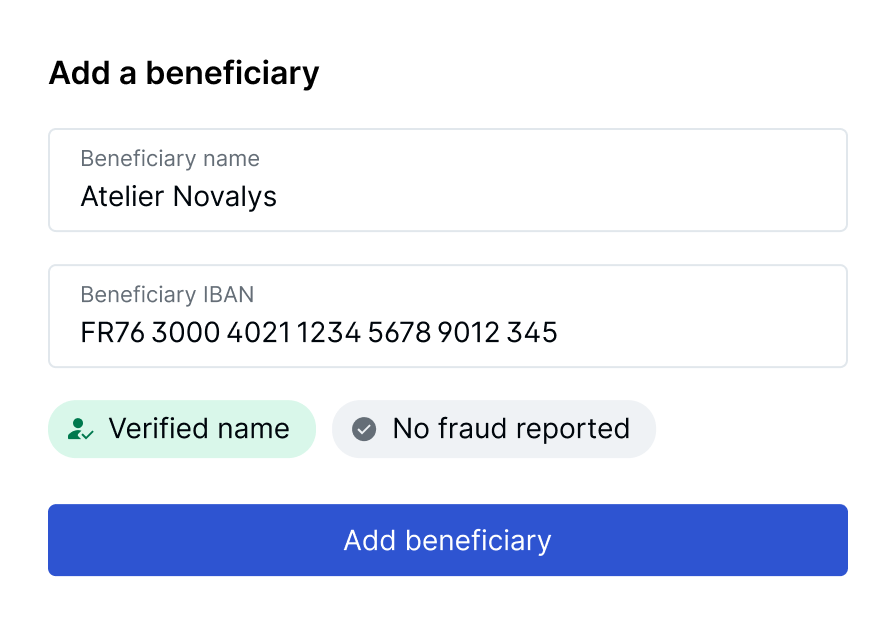

Memo Bank Protect performs a systematic two-step IBAN verification:

1. Name-IBAN Matching: We ensure that the beneficiary's name correctly matches the provided IBAN, thereby thwarting identity impersonation attempts.

2. Reputation Analysis: We check if the IBAN has been previously associated with alerts or fraudulent activities reported on our network.

This dual-layer security is always active, both when adding a new beneficiary and before the approval of each wire transfer.

Instantly obtain essential information about your partners, such as the company's creation date, the owner’s name, and its business sector. This allows you to validate your suppliers' identities before making a payment, helping you avoid common scams like supplier fraud and CEO fraud.

You can implement a validation workflow for IBANs and transfers, requiring administrator approval directly from our banking interface. This dual validation strengthens your first line of defense against internal and external fraud attempts.

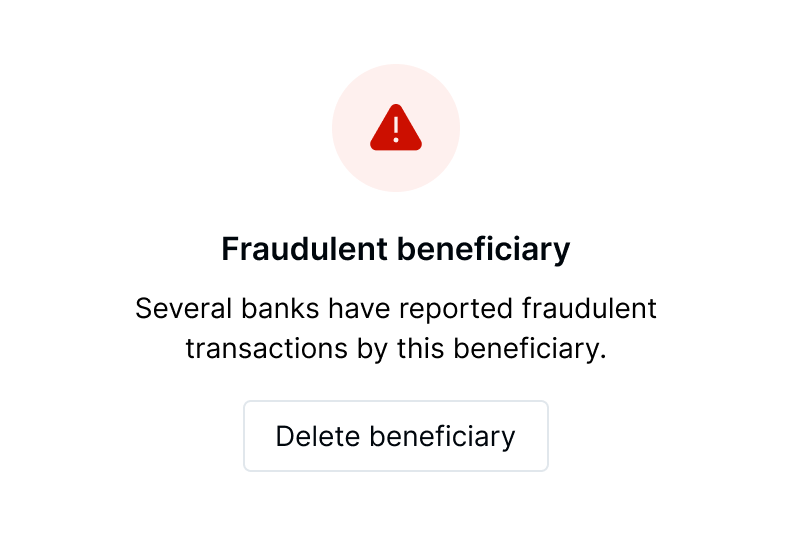

Memo Bank Protect continuously verifies your beneficiaries' details against a database of reported accounts. If you attempt to make a wire transfer to an IBAN that has been recently identified as fraudulent, a real-time alert will appear on your screen, in addition to an email notification. This automatic check gives you the necessary reaction time to cancel the operation and protect your business.

In addition to Memo Bank Protect, we provide an arsenal of tools to protect your business, including virtual IBANs, direct debit blocking, real-time visibility over all company’s financial movements, and automated financial workflows via our Premium banking API.

Our algorithms query the most reliable and current services or platforms, such as the EBA Clearing's FPAD (Fraud Pattern Anomaly Detection) and Pappers (a corporate registry website) for legal information.

While most financial players treat security as a paid option, we see it as the foundation of our partnership. All our subscription plans include a comprehensive risk management component, with no extra fees or complex technical integration.

Banking as it should be.

Memo Bank is a limited company (Société Anonyme) with an Executive Board and a Supervisory Board with a capital of €13,084,327.35 and accredited as a credit institution by the European Central Bank and regulated by the French Prudential Supervision and Resolution Authority (4 place de Budapest, 75009 Paris). For investment services, Memo Bank acts as a tied agent of Twenty First Capital, a portfolio management company authorized by the Autorité des Marchés Financiers under number GP-11000029, registered with ORIAS under number 25004636.

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed

Use cases

Do you need to release orders quickly with your suppliers? Fulfill your commitments without tapping into your liquidity too early? At Memo Bank, everything is designed to accelerate your execution speed